In today’s digital age, opening a bank account has become more convenient than ever. Kotak Mahindra Bank, one of India’s leading private sector banks, offers a seamless online account opening process. In this comprehensive guide, we’ll walk you through the step-by-step process of opening an account with Kotak Bank online, ensuring a hassle-free experience from the comfort of your home.

Step 1: Visit the Kotak Bank Website

To begin your online account opening journey, visit the official Kotak Bank website. Navigate to the “Personal Banking” section and click on the “Accounts” tab. From the dropdown menu, select “Savings Account” or the type of account you wish to open.

Step 2: Choose the Account Type

Kotak Bank offers a variety of savings account options tailored to different customer needs. Take a moment to explore the features and benefits of each account type, such as the 811 Account, Silk Account, or the regular Savings Account. Once you’ve found the account that best suits your requirements, click on the “Apply Now” or “Open an Account” button.

Step 3: Provide Personal Information

You will now be directed to the online application form. Begin by providing your personal details, including your full name, date of birth, gender, PAN number, and Aadhaar number. Ensure that the information you enter matches the details on your official documents.

Next, fill in your contact details, such as your mobile number and email address. Kotak Bank will use these details to communicate with you throughout the account opening process and for future correspondence.

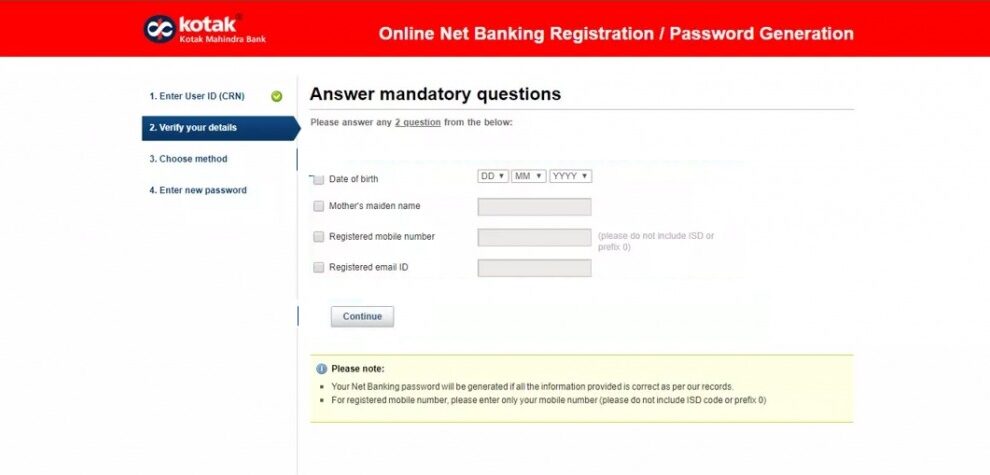

Step 4: Complete the KYC Process

As per regulatory guidelines, Kotak Bank requires you to complete the Know Your Customer (KYC) process to verify your identity. You’ll need to provide proof of identity and proof of address documents.

For proof of identity, you can upload a scanned copy of your PAN card, Aadhaar card, passport, or voter ID card. For proof of address, you can use documents such as your Aadhaar card, passport, voter ID card, or utility bills (electricity, gas, or telephone bill) that are not older than two months.

Ensure that the uploaded documents are clear, legible, and in the format specified by the bank (usually JPEG, PDF, or PNG).

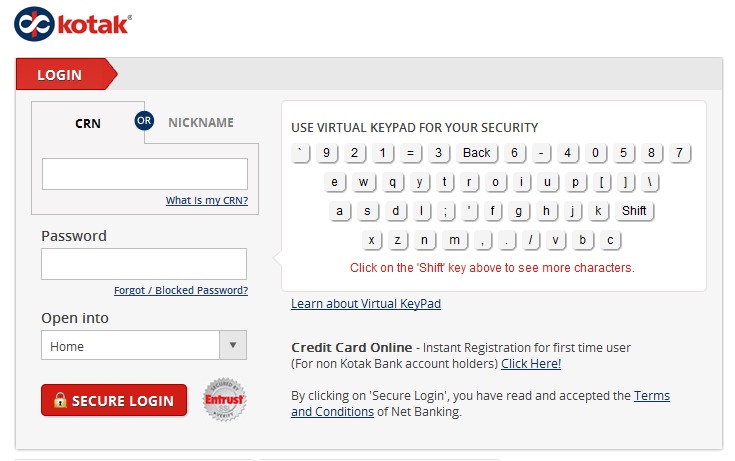

Step 5: Set Up Your Login Credentials

After completing the KYC process, you’ll be asked to set up your login credentials for online banking. Choose a strong and unique username and password that you can easily remember. You may also be prompted to set up security questions and answers for additional security.

Step 6: Fund Your Account

To activate your newly opened Kotak Bank account, you’ll need to make an initial deposit. You can fund your account through various methods, such as online fund transfer from another bank account, using a debit card, or by visiting a Kotak Bank branch or ATM.

The minimum initial deposit amount may vary depending on the type of account you have chosen. Be sure to check the account requirements on the Kotak Bank website or contact their customer support for more information.

Step 7: Verify Your Account

After successfully funding your account, Kotak Bank will verify the information you provided and conduct necessary background checks. This process may take a few hours to a couple of working days. Once your account is verified, you’ll receive a confirmation email or SMS from the bank.

You can now log in to your online banking account using the credentials you set up earlier. From the dashboard, you can access various features such as viewing your account balance, transferring funds, paying bills, and more.

Step 8: Request a Debit Card and Cheque Book

If you require a debit card or cheque book for your newly opened account, you can easily request them online. Log in to your online banking account and navigate to the “Services” or “Requests” section. From there, you can place a request for a debit card or cheque book.

Your debit card will be delivered to your registered address within a few working days. You’ll need to activate the card using the methods specified by the bank, such as through an ATM or by calling the customer support number.

Similarly, your cheque book will be dispatched to your registered address. You’ll receive a confirmation once the cheque book is ready for delivery.

Step 9: Explore Additional Features

Kotak Bank offers a wide range of digital banking services to enhance your banking experience. Take some time to explore the features available through online banking and the Kotak Mobile app.

Some notable features include:

- Insta Alert: Get real-time notifications for transactions and account activity.

- Insta Pay: Transfer funds instantly to other Kotak Bank accounts or to accounts with other banks using IMPS or NEFT.

- Insta Debit Card Block: Instantly block your debit card if it’s lost or stolen.

- E-Statements: Access your account statements online, eliminating the need for physical statements.

By exploring these features, you can make the most of your Kotak Bank online banking experience and manage your finances effortlessly.

Conclusion

Opening an account with Kotak Bank online is a simple and convenient process. By following the steps outlined in this guide, you can have your new account up and running in no time. Remember to provide accurate information, complete the KYC process, and keep your login credentials secure.

If you encounter any difficulties during the account opening process or have further questions, don’t hesitate to reach out to Kotak Bank’s customer support. They are available through various channels, including phone, email, and live chat, to assist you with any queries or concerns.

With your Kotak Bank online account, you can enjoy a seamless banking experience and take advantage of the wide range of digital services offered by the bank. Start your financial journey with Kotak Bank today and experience the convenience of online banking!

For more information and detailed instructions, visit the Kotak Bank Savings Account page.

Add Comment