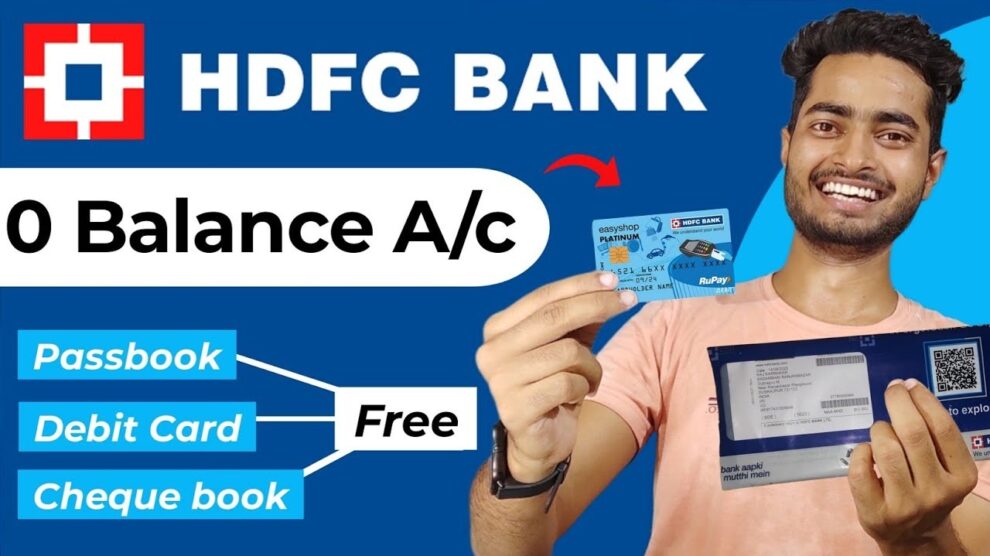

introductory remarks: One of the top private sector banks in India, HDFC Bank, provides a practical choice for people wishing to open a savings account with no minimum balance requirements. Zero-balance accounts are appealing to individuals who seek freedom in managing their finances, are open to new earners or students, and allow you to keep an account without having to maintain a minimum level. We will take you step-by-step through the process of opening an HDFC zero balance account in this extensive guide.

Step 1: Go to the website of HDFC Bank

Visit the official HDFC Bank website at www.hdfcbank.com to start the account opening procedure. Hover your cursor over the “Personal Banking” tab on the homepage, then choose “Accounts” from the drop-down menu. Afterwards, select “Savings Accounts” to see the available choices.

Step 2: Select the Account with a zero balance.

Find the “Basic Savings Account” or “Zero Balance Savings Account” from the list of available savings account options. To discover further information and the qualifying requirements, click on the account type. Make sure you fulfill the conditions to open the account.

Step 3: Compile Necessary Documents

You will need to provide various identity and address verification documents in order to open an HDFC zero balance account. Hold onto the following documents:

- Aadhaar Card

- PAN Card

- Photos the size of a passport

- Proof of Address (such as a utility bill, passport, or driver’s license)

Verify that the documents are current, legitimate, and easily readable.

Complete the Online Application Form in Step 4

Click the “Apply Online” or “Open Now” button to start the online application process if you have the required paperwork. After that, you’ll be taken to a safe online application form. Complete all fields with precision, making sure to include:

-

- Personal Details (Name, Gender, and Date of Birth)

Contact Information (Email Address, Cell Number)

Address Specifications (Transactional and Permanent Address)

Details of Occupation and Income

Details of the Nominee (Optional)

Before moving on to the next stage, make sure all the information has been input twice.

Step 5: Upload Necessary Files

You will be asked to upload scanned copies or clear photographs of the necessary papers after completing the application form. To upload each document in the required format (typically JPEG, PNG, or PDF), follow the instructions provided. Verify that the uploaded files are legible and clear.

Step 6: Check and Send in the Form

Examine all the information you have provided carefully before submitting your application. Make sure that the data is correct and corresponds with the files that were uploaded. If everything checks out, click “Submit” or “Proceed” to send your application to HDFC Bank for processing after accepting the terms and conditions.

Step 7: Await Account Opening and Verification

Following the submission of your application, HDFC Bank will check the supplied data and supporting documentation. If more information is needed, they might get in touch with you to set up a video KYC (Know Your Customer) procedure. Your zero-balance account will be opened by HDFC Bank as soon as your application is accepted, and you will receive an email or SMS confirming the account details.

Step 8: Proceed with Activating and Utilizing Your Account

You might need to finish a few more steps, such setting up your online banking credentials or connecting your cell number, in order to activate your HDFC zero balance account. To activate your account, adhere to HDFC Bank’s instructions. You can use your account for transactions, deposits, and other financial services as soon as it’s activated.

A Common Questionnaire

Does an HDFC zero-balance account have a minimum balance requirement?

No, there is no minimum balance requirement for HDFC zero-balance accounts like the Basic Savings Account. You are not charged or subject to penalties if you keep your account balance at zero.

Is it possible to open a zero-balance HDFC account offline?

Yes, you can open an account with no balance by going to the HDFC Bank branch that is closest to you. Nonetheless, creating an account online is quicker and more convenient. You can apply for the account while lounging in your house or place of business.

What advantages and characteristics come with an HDFC zero balance account?

HDFC zero balance accounts come with a number of features and advantages, including:

-

- Absence of a minimum balance requirement

- The debit card feature

Access to banking via mobile and online platforms

RTGS/NEFT money transfers

- Email statements and SMS alerts

- Interest rates that are appealing for account balances

For further information on the features and benefits of a particular account, please visit the HDFC Bank website or get in touch with customer service.

How long does it take to register for an online HDFC account with no balance?

In general, opening an account online is a quick and easy process. Subject to satisfactory verification and KYC compliance, HDFC Bank normally processes and opens your account within a few working days of receiving your application and the necessary papers.

Take Advantage of an HDFC Zero Balance Account’s Flexibility

You can begin your banking career with ease and convenience by opening an HDFC zero balance account, which eliminates the need to worry about keeping a minimum amount. You may quickly apply for an account online and take advantage of HDFC Bank’s banking privileges by following the step-by-step instructions provided in this article.

The HDFC zero balance account affords you the liberty to handle your funds in accordance with your requirements and inclinations. You are not required to keep a minimum balance in order to utilize a variety of banking services, including as fund transfers, debit card transactions, and online and mobile banking.

Become financially independent and convenient by creating an HDFC zero-balance account right now. Accept the comfort of handling your finances with HDFC Bank and embrace the potential of digital banking.

Add Comment