A well-known provider of financial services in India, Angel One (previously known as Angel Broking) provides a variety of investing options, including demat accounts. It is simpler to trade and manage your investments when you have access to your shares and securities in an electronic format through a demat account. We’ll walk you through the steps of opening an Angel One demat account in this guide.

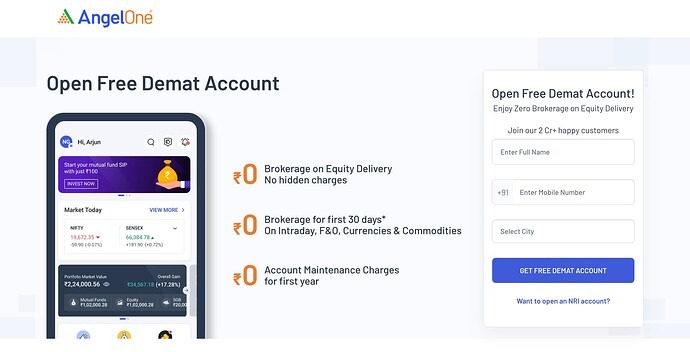

Advantages of Signing Up for an Angel One Demat Account

Let’s examine the advantages of having a demat account with Angel One before moving on to the account opening process:

-

- Access to a large selection of investment goods, such as mutual funds, stocks, and initial public offerings (IPOs)

Easy-to-use mobile app and web trading platform for seamless investing Competitive pricing plans and brokerage rates

Tools for research and analysis to assist you in making wise investing decisions

a dependable and safe platform with strong security controls

Qualifications to Open an Angel One Demat Account

To initiate a demat account with Angel One, you have to fulfill the subsequent qualifying requirements:

-

- You have to be a resident of India

You have to be at least eighteen years old

A valid PAN card is required.

A working bank account is a requirement.

Detailed Instructions: Opening a Demat Account in Angel One

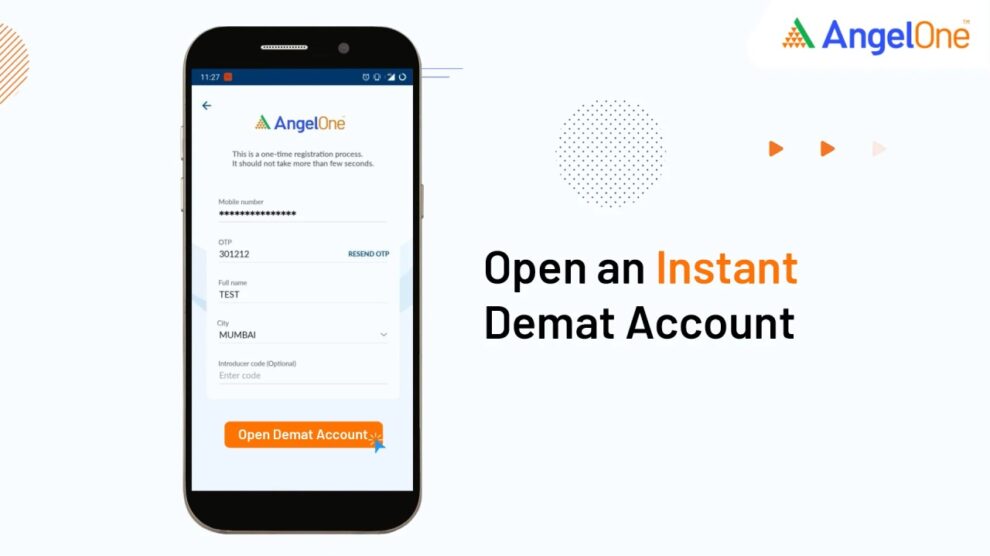

Step 1 is to go to the Angel One website.

Click the “Open an Account” button after visiting the Angel One website to start the account opening procedure.

Step 2 involves completing the online application form.

An online application form will be sent to you. Enter your contact information, name, address, and date of birth in the personal details field. Your bank account information and PAN card details are also required.

Step 3: Upload Necessary Files

You must upload the following files in order to finish the account opening process:

Pan Card

-

- A proof of address, such as a utility bill, passport, or Aadhaar cardIdentification proof (such as a voter ID, passport, or Aadhaar card)

Bank statement or cancelled check

In-person verification (IPV): Finish Step 4

You will have to finish the In-Person Verification (IPV) procedure following the submission of your online application. A representative from Angel One will come to your home to confirm your paperwork and get your signature.

Activate Your Demat Account: Step 5

Angel One will activate your demat account after the IPV procedure is finished and your application is accepted. Your Client ID and BO ID, together with other account information, will be sent to you through email.

Frequently Asked Questions Regarding Angel One’s Demat Account Opening

How long does it take to register for an Angel One demat account?

If all the necessary paperwork is submitted and the IPV procedure is finished, creating an account normally takes two to three business days.

Do Angel One demat accounts have a minimum balance requirement?

No, Angel One demat accounts do not need to have a minimum balance. To make trades, you might, nevertheless, need to keep a minimum amount in your trading account.

If I’m a non-resident Indian (NRI), may I open a demat account with Angel One?

Angel One does provide NRIs with demat account services. The rules and method for creating an account, however, can be a little different from those for Indian residents. Make sure to inquire about specific guidelines from Angel One.

Result

Angel One’s demat account opening procedure is a quick and easy online process that only requires a few simple steps to finish. Set up your demat account and begin investing in the Indian stock market immediately by following the above guide and supplying the required documents and information. Angel One’s user-friendly platform, affordable pricing, and extensive research tools will provide you with the necessary skills to make wise investment selections and gradually increase your wealth.

Add Comment