Opening a savings account with Lloyds Bank is a smart way to save money and earn interest on your savings. Lloyds Bank offers a variety of savings accounts to suit different needs and goals, whether you’re saving for a rainy day, a big purchase, or your future. In this guide, we’ll walk you through the process of opening a savings account with Lloyds Bank.

Step 1: Choose the Right Savings Account

Lloyds Bank offers several types of savings accounts, each with different features, interest rates, and access options. Some popular savings accounts include:

- Easy Saver: A simple, instant-access savings account with a variable interest rate.

- Club Lloyds Monthly Saver: A regular savings account that allows you to save up to £400 per month with a fixed interest rate for 12 months.

- Fixed-Term Savings: A range of fixed-rate savings accounts with terms ranging from 1 to 5 years offer guaranteed returns on your savings.

Consider your savings goals, the amount you want to save, and how often you’ll need to access your funds when choosing the right savings account for you.

Step 2: Check Your Eligibility

To open a savings account with Lloyds Bank, you must:

- Be 18 years of age or older (some accounts may have different age requirements)

- Be a UK resident

- Have a valid UK address

- Provide proof of identity and address

Some savings accounts may have additional eligibility criteria, such as being an existing Lloyds Bank current account holder or meeting minimum deposit requirements.

Step 3: Apply Online or in-person.

You can open a Lloyds Bank savings account online or by visiting a branch. To apply online:

- Go to the Lloyds Bank website (https://www.lloydsbank.com/) and navigate to the “Savings” section.

- Select the savings account you want to open and click “Apply Now.

- Follow the on-screen instructions to complete the application form, providing your personal details and proof of identity and address.

- Review and submit your application.

To apply in person, simply visit your local Lloyds Bank branch and speak with a representative about opening a savings account. They will guide you through the application process and help you choose the right account for your needs.

Step 4: Fund Your Account

Once your application is approved, you’ll need to fund your new savings account. You can do this by:

- Transferring money from an existing Lloyds Bank account

- Setting up a standing order or direct debit from another bank account

- Depositing cash or a check at a Lloyds Bank branch

Some savings accounts may have minimum initial deposit requirements or maximum deposit limits, so be sure to check the account terms and conditions.

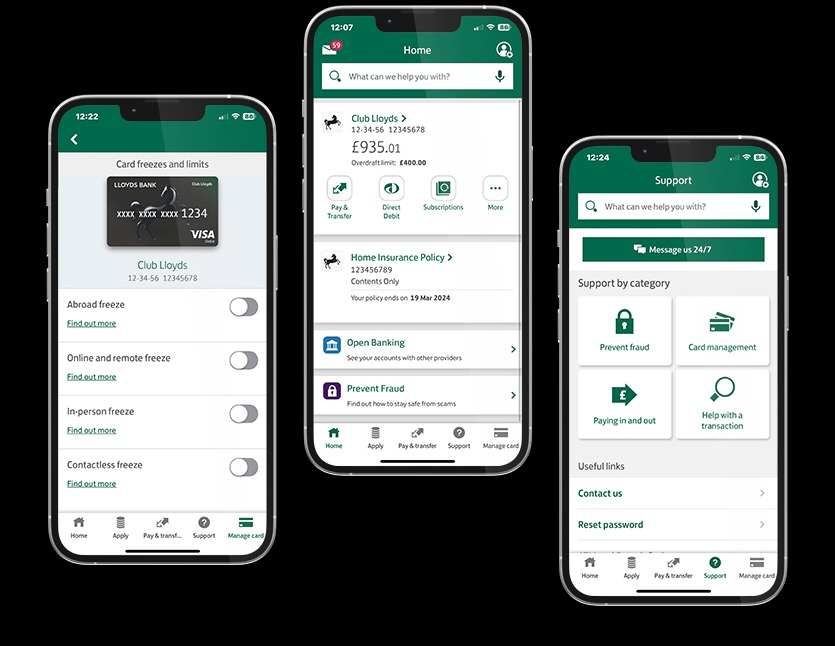

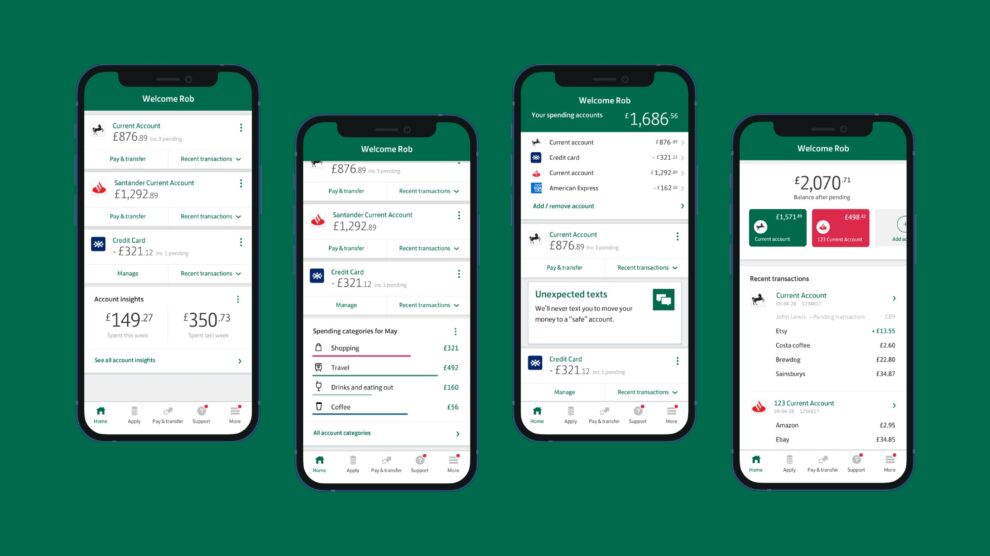

Step 5: Manage Your Savings

With your Lloyds Bank savings account open and funded, you can start managing your savings. This includes:

- Setting up regular payments or transfers to your savings account

- Checking your balance and transaction history online or through mobile banking

- Adjusting your savings goals and contributions as needed

- Taking advantage of any additional features or benefits offered by your savings account

Remember to review your savings account regularly and keep track of your progress towards your savings goals.

Step 6: Stay Informed About Interest Rates and Account Changes

Interest rates on savings accounts can change over time, and Lloyds Bank may introduce new savings products or make changes to existing accounts. To make the most of your savings, stay informed about:

- Current interest rates on your savings account

- Any changes to your account’s terms and conditions

- New savings accounts or special offers that may suit your needs better

You can find this information on the Lloyds Bank website, through online banking, or by contacting customer support.

Conclusion

Opening a savings account with Lloyds Bank is a simple and effective way to grow your savings and achieve your financial goals. By choosing the right account, meeting the eligibility criteria, and managing your savings regularly, you can make the most of your money and enjoy the benefits of saving with a trusted, established bank.

Remember to compare different savings accounts, read the terms and conditions carefully, and seek advice from a financial professional if you have any questions or concerns about your savings strategy. With a Lloyds Bank savings account, you can save with confidence and take control of your financial future.

Add Comment