Opening a bank account with Lloyds Bank online is a simple and convenient process that can be completed from the comfort of your home. Lloyds Bank offers a range of account options to suit your needs, whether you’re looking for a personal current account, a savings account, or a joint account. In this guide, we’ll walk you through the steps to opening a Lloyds Bank account online.

Step 1: Check Your Eligibility

Before you start the application process, make sure you meet the eligibility criteria for opening a Lloyds Bank account. To open an account, you must:

- Be 18 years of age or older

- Be a UK resident

- Have a valid UK address

- Provide proof of identity and address

If you meet these requirements, you can proceed with the online application.

Step 2: Visit the Lloyds Bank Website

Go to the Lloyds Bank website (https://www.lloydsbank.com/) and click on the “Banking” tab at the top of the page. From the drop-down menu, select “Current Accounts” to view the available account options.

Step 3: Choose an Account Type

Lloyds Bank offers several types of current accounts, each with different features and benefits. Some popular options include:

- Classic Account: A standard current account with no monthly fee, suitable for everyday banking needs.

- Club Lloyds Account: An account that offers interest on balances and additional benefits for a monthly fee.

- Student Account: An account designed for students, with an interest-free overdraft and other student-friendly features.

Select the account type that best fits your needs and click on “Apply Now” to start the application process.

Step 4: Fill out the Online Application Form

The online application form will ask for your personal details, including:

- Full name

- Date of birth

- Email address

- Phone number

- UK address

- Employment status and income

Make sure to provide accurate information, as Lloyds Bank will use this to verify your identity and assess your eligibility for the account.

Step 5: Provide Proof of Identity and Address

To comply with UK anti-money laundering regulations, Lloyds Bank will need to verify your identity and address. You can do this by providing electronic copies of acceptable documents, such as:

- Passport

- Driving license

- Utility bill (dated within the last 3 months)

- Bank statement (dated within the last 3 months)

Follow the instructions on the application form to upload your documents securely.

Step 6: Submit Your Application

Once you’ve completed the application form and provided the necessary documentation, review your details carefully to ensure everything is correct. Then, click on the “Submit” button to send your application to Lloyds Bank.

Step 7: Wait for a Decision

Lloyds Bank will process your application and make a decision based on the information you’ve provided. This usually takes a few working days, but in some cases, it may take longer if they require additional information or documentation.

If your application is approved, Lloyds Bank will contact you to confirm your account details and arrange for your debit card and other account materials to be sent to your UK address.

Step 8: Activate Your Account

Once you receive your debit card and account information in the mail, follow the instructions provided to activate your account. This typically involves calling a dedicated activation line or logging into your online banking portal to complete the setup process.

Step 9: Start Using Your Lloyds Bank Account

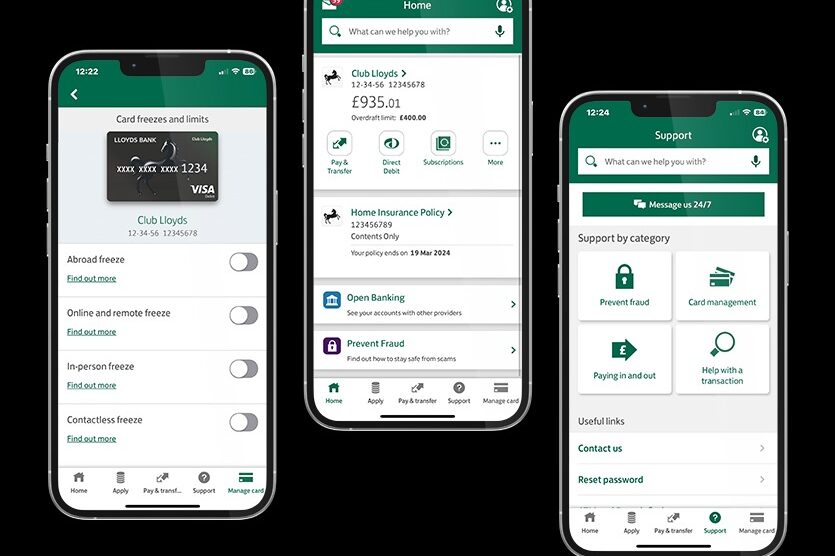

With your account activated, you can start using your Lloyds Bank account for your everyday banking needs. This includes:

- Setting up direct debits and standing orders

- Making payments and transfers

- Checking your balance and transaction history

- Managing your account settings and preferences

You can access your account through online banking, mobile banking, telephone banking, or by visiting a Lloyds Bank branch.

Conclusion

Opening a Lloyds Bank account online is a straightforward process that can be completed in a matter of minutes. By following the steps outlined in this guide and providing the necessary information and documentation, you can enjoy the benefits of a Lloyds Bank account from the convenience of your own home.

Remember to keep your account details secure, regularly monitor your transactions, and contact Lloyds Bank if you have any questions or concerns about your account. With a Lloyds Bank account, you can manage your finances with ease and confidence.

Add Comment