Are you prepared to start your investing journey and take charge of your financial future? A wise and easy approach to begin stock market investing is to open an account with Angel One, one of India’s top online stock trading platforms. We’ll walk you through the entire process of how to open an account in Angel One in this in-depth guide, giving you all the knowledge you need to start trading with confidence and make wise judgments.

Why Opt for Angel One for Your Needs in Investing?

Let’s examine why Angel One is a great option for both new and seasoned investors before getting into the specifics of how to open an account with Angel One:

- User-Friendly Interface: Users may easily explore investment opportunities and manage their portfolios with Angel One’s intuitive and user-friendly platform.

- Thorough information and Analysis: To assist you in making wise investment decisions, Angel One provides you with access to comprehensive market information, professional insights, and strong analytical tools.

- Competitive Pricing: Angel One guarantees that you may optimize your profits and cut expenses by offering competitive brokerage rates and fees.

- Strong Security Measures: Angel One places a high premium on your financial security, and to that end, it uses cutting edge encryption and security procedures to safeguard your private data and transactions.

- Broad Product Selection: Angel One provides an extensive selection of investment products to meet your requirements and objectives, regardless of your interest in stocks, derivatives, mutual funds, or other financial instruments.

Detailed Instructions: Opening an Angel One Account

Now that you are aware of the advantages of selecting Angel One, let’s go over the steps involved in opening an account:

Step 1: Go to the website of Angel One

Go to the official Angel One website at www.angelone.in to start the process of opening an account. Click the “Open an Account” button on the homepage, which is situated in the upper right corner of the screen.

Step 2: Enter Your Cell Phone Number

Click the “Continue” button after entering your mobile number in the designated space on the account opening page. For the purpose of verification, Angel One will text your cell number with a One-Time Password (OTP).

Step 3: Type in your OTP

To continue with the account opening process, input the OTP that you receive on your mobile device into the designated space on the Angel One website. This step guarantees your application’s security and legitimacy.

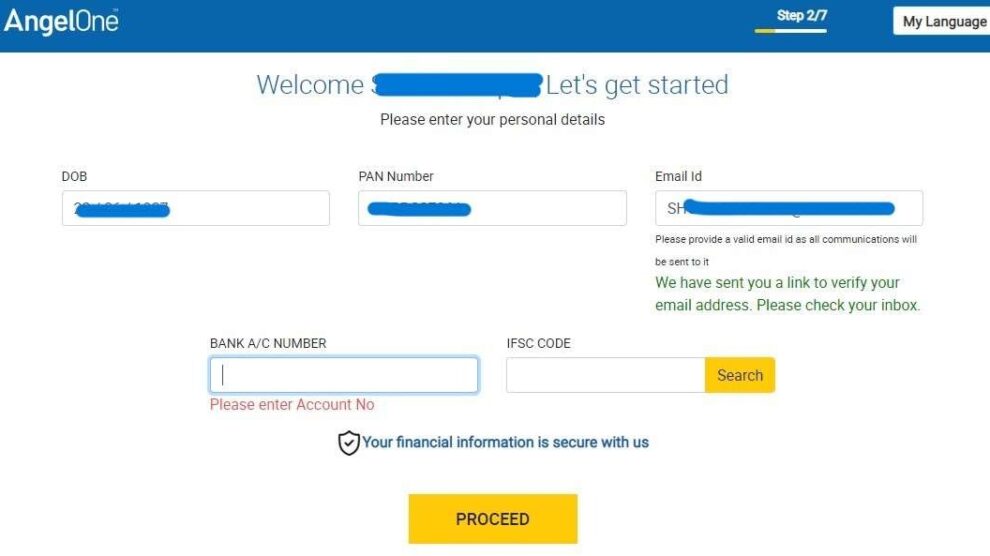

Step 4: Provide Your Personal Information

Providing your personal information is the next stage in the how to open an account in Angel One process. Your date of birth, email address, PAN card number, and residential address must all be entered. To prevent any delays in the account opening procedure, make sure the information you enter is correct and corresponds with your official documentation.

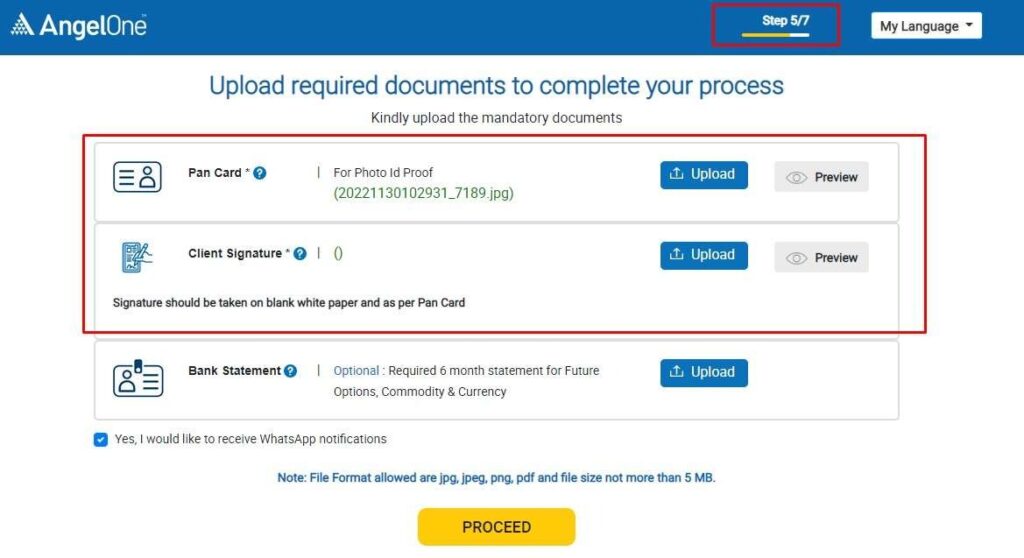

Step 5: Finish the KYC Procedure

All account holders are required by Angel One to complete the Know Your Customer (KYC) process in order to adhere to regulatory standards and preserve the integrity of financial transactions. This entails providing identity and address verification documents, like:

-

- The PAN Card

Aadhar Card or any other authorized document (passport, voter ID card, driver’s license, etc.) that demonstrates one’s addressA canceled check or a statement of bank accounts

- Photo the size of a passport

Signature example (picture or scanned copy)

To finish the KYC procedure and proceed with the transaction, upload scans of these papers that are clear and readable or excellent photos of them. how to create an Angel One account.

Step 6: Decide on Your Trading Segments and Account Type

To accommodate diverse investment inclinations, Angel One provides a range of account kinds and trading segments. Select the kind of account you want to open, either a Demat account, a Trading account, or both. Choose the categories you want to trade in as well. These could include commodities, equity, futures and options (F&O), currency, and more. When making these decisions, take your risk tolerance and investing objectives into account.

Step 7: Supply Bank Information and Nominee Details

You will need to supply your bank account details, including the account number and IFSC code, in order to enable smooth transactions and guarantee the security of your investments. Choosing a beneficiary for your Angel One account is also very important. This is a crucial step in the Angel One account opening process since it protects your money in case of unanticipated events.

Step 8: Examine and electronically sign the application

Make sure all the information you’ve supplied is accurate and complete before completing your application. Once the information is satisfactory to you, e-sign the application by uploading your scanned signature or using your Aadhaar-based OTP. This digital signature expedites the account opening procedure and legally authorizes your application.

Step9: Fund Your Account and Activate It

Making the required payment for account opening costs and any other applicable fees is the last step in the how to open an account in Angel One process. For your convenience, Angel One offers a number of payment methods, such as credit/debit cards, online banking, and UPI. Your account will be activated and you will be prepared to begin your investing journey as soon as your payment has been received and your application has been accepted by the Angel One verification team.

Exploring Angel One Platform Navigation

Well done on your successful Angel One account opening! After completing the steps for opening an account in Angel One, you should now take some time to get acquainted with the platform and utilize all of its features:

Investigate the Interface

Spend some time exploring the Angel One website and mobile app to become acquainted with its design, features, and menus. Accessing market data, placing orders, keeping an eye on your portfolio, and managing account settings are all made simple by the user-friendly design.

Make Use of Research and Analysis InstrumentsTo help you make more informed financial decisions, Angel One offers an abundance of research and analytical tools. To stay updated and spot possible investment opportunities, check out the platform’s technical charts, company reports, market insights, and expert advice.

Tailor Your Alerts and Watchlists

Make customized watchlists to monitor stocks, indices, and other interest-related financial instruments. To be informed about big market fluctuations and act promptly, set up price alerts and notifications.

Get Involved with Educational Resources

To assist you improve your knowledge and abilities in trading, Angel One provides a variety of educational tools, such as seminars, tutorials, and articles. Use these tools to your advantage to learn about various approaches to market analysis, risk management, and investing.

Make Sure Your Angel One Account Is Secure.

Prioritizing the security of your account and personal information is just as important as learning how to register an account in Angel One. Adhere to these recommended guidelines to safeguard your Angel One account:

- Make a strong password that is distinct from others by combining capital and lowercase letters, digits, and special characters. Reusing passwords from different accounts or information that can be guessed are not recommended.

- Turn on two-factor authentication (2FA) to provide another degree of protection. To make sure that nobody else can access your account, you must enter a special code that is provided to your registered email address or mobile number each time you log in.

- Update the operating system and antivirus software on your computer or mobile device on a regular basis to guard against any security threats and vulnerabilities.

- Phishing efforts and phony emails or messages purporting to be from Angel One should be avoided. It is advisable to confirm the legitimacy of any correspondence before divulging confidential details or opening links.

Result

A step toward reaching your financial objectives and an introduction to the fascinating world of investing is opening an account with Angel One. You may open an account with confidence and ease if you follow this thorough tutorial on how to open an account in Angel One.

In order to make wise investment decisions, don’t forget to give accurate information, carefully fulfill the KYC criteria, and take advantage of the platform’s features. Remain dedicated to your education, keep an eye on the big picture, and periodically examine and tweak your investing plans in light of your changing objectives and the state of the market.

As your dependable partner, Angel One gives you access to a strong platform, in-depth industry intelligence, and an encouraging investor community. Seize the chance to start a profitable investing adventure with Angel One and embrace the chances that lie ahead.

Open an account with Angel One to get started on your investment journey and discover the financial markets’ full potential!

Add Comment