Opening a joint account with Union Bank is a great way to manage shared finances with your spouse, partner, or family member. A joint account allows multiple people to access and manage the funds together. This guide will walk you through the process of opening a joint account with Union Bank.

Step 1: Determine Account Holders

Decide who will be the joint account holders. All account holders must be present to open the account and will have equal access and responsibility for the funds in the account.

Step 2: Gather Required Documents

To open a joint account, each account holder must provide the following documents:

- Valid government-issued photo ID (e.g., driver’s license, passport)

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Proof of current address (e.g., utility bill, lease agreement)

Step 3: Choose the Type of Joint Account

Union Bank offers several types of joint accounts, including:

- Joint Savings Account

- Joint Checking Account

- Joint Certificate of Deposit (CD)

Consider your financial needs and goals when selecting a type of joint account.

Step 4: Visit a Union Bank Branch

Schedule an appointment or walk into a Union Bank branch with all account holders present. Inform the bank representative that you wish to open a joint account.

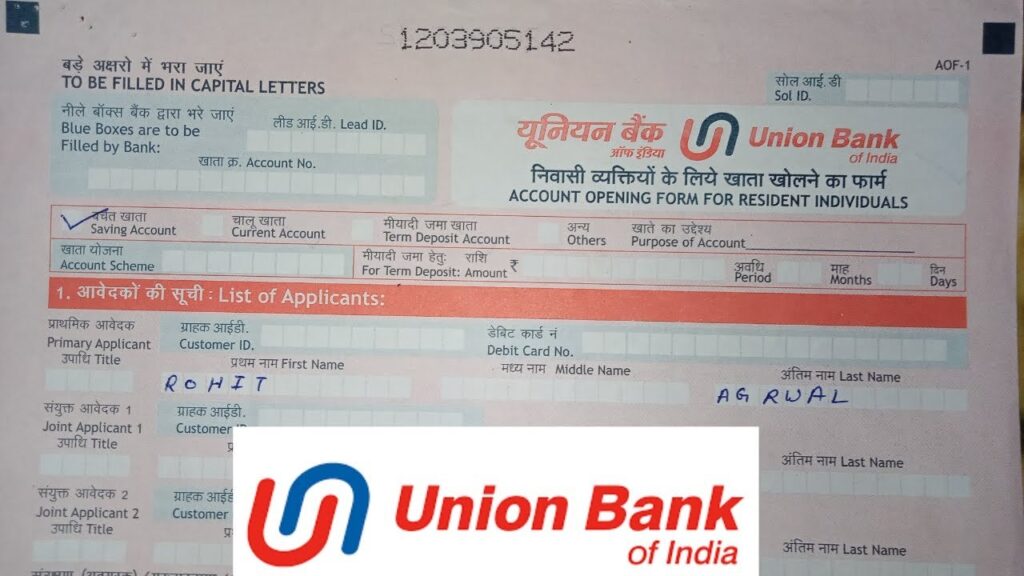

Step 5: Fill Out the Account Application

Complete the joint account application that the bank representative has provided. All account holders must provide their personal information, including:

- Full name

- Date of birth

- Address

- Phone number

- Email address

- Employment information

Step 6: Provide Identification and Documentation

Present the required identification and documentation for each account holder to the bank representative. They will make copies of these documents for the bank’s records.

Step 7: Make an Initial Deposit

Most Union Bank accounts require an initial deposit to open. Be prepared to make this deposit when opening your joint account. The minimum deposit amount may vary depending on the type of account you choose.

Step 8: Sign the Account Agreement

Review and sign the joint account agreement, which outlines the terms and conditions of the account. All account holders must sign the agreement.

Step 9: Receive Your Account Documents

Once your joint account is opened, you will receive your account documents, including your account number, debit cards (if applicable), and online banking information.

Congratulations! You have now successfully opened a joint account with Union Bank. You and your joint account holder(s) can now start managing your shared finances and working towards your financial goals together.

Please note that specific requirements, steps, and account features may vary slightly depending on your location and any updates to Union Bank’s account opening process. Always refer to the official Union Bank website or contact a bank representative for the most accurate and up-to-date information.

Add Comment