The procedures below can be used to open an account with Zerodha, the biggest stock brokerage company in India:

1. Check Out the Zerodha Website

Click “Sign up” or “Open an account” on the Zerodha website.

2. Complete the Online Form to Open an Account.

Enter your personal information, such as your name, birthdate, address, PAN card number, and phone number. Additionally, you must decide which kind of account to open—trading, investing, or both.

3. Ensure that the Know Your Customer (KYC) Process is finished.

To open a trading and demat account, you have to finish the KYC process as per SEBI requirements. Providing identity and address verification documents, like your PAN card, Aadhar card, passport, voter ID, or driver’s license, is required for this.

4. Sign the documents electronically

You will need to use Aadhaar-based e-signatures to e-sign the account opening form and other pertinent documents after completing the online application and KYC process.

5. Transfer Money Into Your Account

You must fund your account in order to begin trading when it has been approved. Zerodha provides a number of payment methods, including as bank transfers, UPI, and net banking.

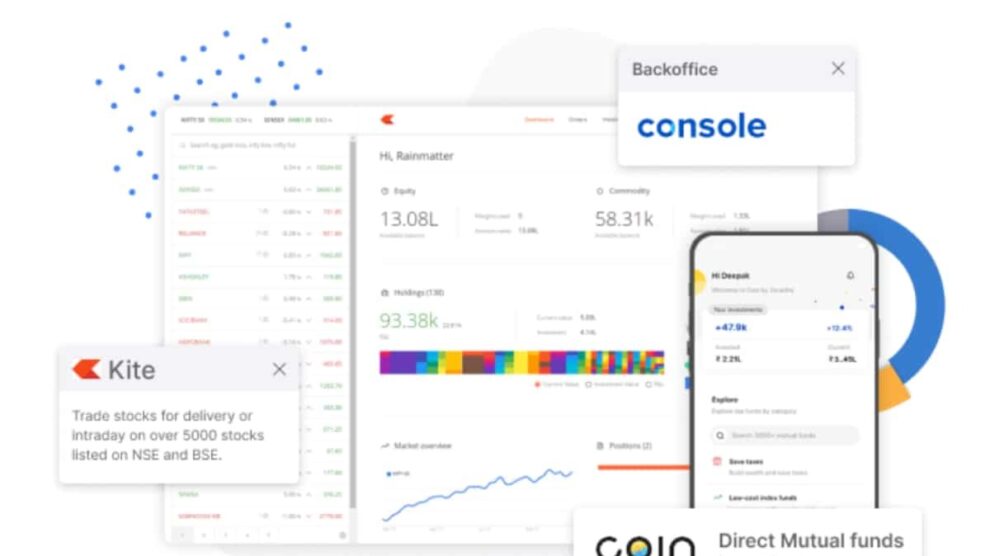

6. Initiate Trading

Once your account has been funded, you can begin trading stocks, derivatives, mutual funds, and other financial instruments by downloading the Zerodha trading app (Kite) or logging in to the website.

It’s important to know that Zerodha offers reasonable brokerage rates together with a small account opening cost. Make sure you have a clear financial plan in place and are aware of the dangers associated with trading and investing before opening an account.

Visit the Zerodha account opening page or get in touch with their customer service staff for further details and comprehensive instructions on opening a Zerodha account.

Add Comment