Users of PhonePe, a well-known digital payment network in India, can conduct transactions, settle invoices, and keep money in a virtual wallet. It is possible to register a PhonePe account without a bank account, even though most users link their accounts to one. This tutorial will explain how to register a PhonePe account without a bank account and go over the benefits and drawbacks of this kind of account.

advantages of opening a PhonePe account without first opening a bank account

You might want to register a PhonePe account without a bank account for the following reasons:

-

- You don’t want to link your bank account to PhonePe, or you don’t have one.You should keep your PhonePe transactions and bank account transactions apart

You wish to utilize PhonePe’s services, such bill payment and cell recharge, without disclosing your bank information

Limitations of a PhonePe Account in the Absence of a Bank Account

Although it is possible to create a PhonePe account without a bank account, there are a few restrictions to take into account:

-

- Money transfers from your PhonePe wallet to a bank account are not possible.

Compared to accounts connected to a bank account, you might have lower transaction limits

Certain functions that require a linked bank account will not be available to you, such investing in mutual funds or purchasing insurance.

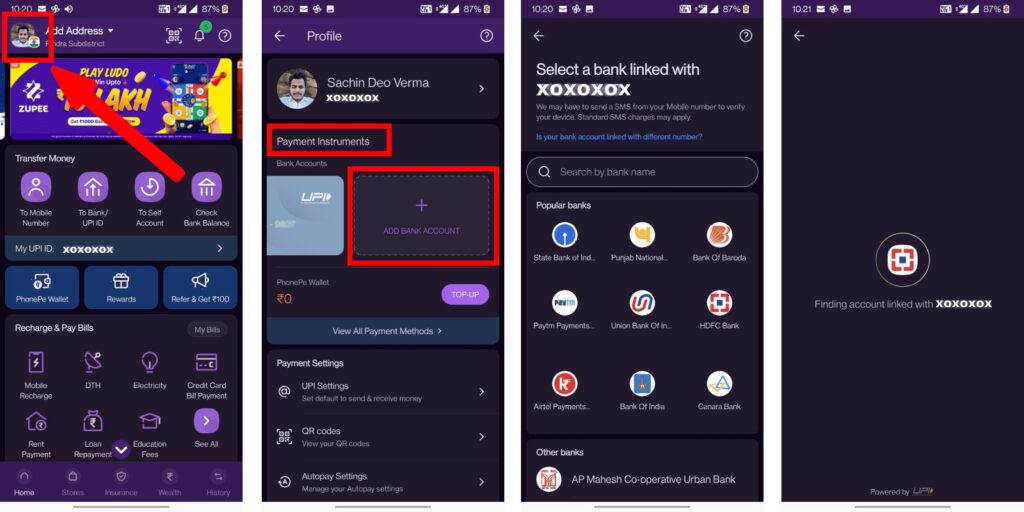

Detailed Instructions: Opening a PhonePe Account Without a Bank Account

First, get the PhonePe app.

Download the PhonePe app from the Google Play Store (for Android users) or App Store (for iPhone users) to start the account opening procedure.

Step 2: Enter your mobile number and click “Sign Up”

After launching the PhonePe application, select the “Sign Up” option. After providing your cellphone number, select “Get OTP.” Your mobile number will receive a one-time password (OTP) from PhonePe for verification.

Step 3: Set a PIN and Enter the OTP

Set a 4-digit PIN for your PhonePe account and enter the OTP that was sent to your mobile number. To access your account and make transactions, you will need to enter this PIN.

Step 4: Enter Your Personal Information

Enter your name, email address, and birthdate in the personal information field. Your address information will also be required.

Step 5: Confirm Your Customer (KYC) Information

You must finish the KYC procedure in order to utilize PhonePe’s services. By presenting your Aadhaar card details or another kind of official identification, you can accomplish this. Depending on the services you wish to use, PhonePe might need more documentation.

Step 6: Get Your PhonePe Account Started

You can begin using your PhonePe account to perform transactions, pay bills, and recharge your mobile phone as soon as it is set up and your KYC information are confirmed. By going to a PhonePe partner store, using a credit card, or using the wallet of another PhonePe user, you can add money to your PhonePe wallet.

Frequently Asked Questions pertaining to non-bank account opening for PhonePe accounts

I don’t have a bank account; can I still get money in my PhonePe account?

Yes, even if your PhonePe wallet isn’t connected to a bank account, you can still receive money from other users using it. You will not, however, be able to move this money to a bank account.

Is there a maximum amount of cash that can be kept in an unbanked PhonePe wallet?

Yes, there are restrictions on how much money you may use your PhonePe wallet for transactions and storage. PhonePe sets certain limits, which can change based on your account type and KYC status. To ensure you have the most recent details on transaction and storage restrictions, make sure you contact PhonePe.

Is it possible to utilize PhonePe’s entire feature set without a bank account?

No, some functions need a linked bank account in order to be used, such purchasing insurance or investing in mutual funds. Even without a bank account, you can still make use of a lot of PhonePe’s features, including bill payment, cellphone recharges, and money transfers to other PhonePe users.

Result

Without a bank account, opening a PhonePe account is an easy process that only takes a few minutes to finish. Even though utilizing a PhonePe account without a bank account tied to it has certain restrictions, it can still be a practical way to conduct transactions, pay bills, and keep money online. It is easy to set up your PhonePe account and begin enjoying its services by following the above step-by-step guide and supplying the required KYC details. Just keep in mind to use a strong PIN, keep your account safe, and be conscious of the storage and transaction limits specific to your account type.

Add Comment