A variety of financial services, such as savings accounts, money transfers, and bill payments, are provided by the digital banking platform Airtel Payments Bank. Use this thorough guide to get started if you’re interested in creating an account with Airtel Payments Bank.

Advantages of Creating an Airtel Payments Bank Account

Let’s look at a few advantages of having an Airtel Payments Bank account before we get started with the account opening process:

-

- Digital banking services that are easily accessible via the Airtel Thanks appHigh savings account interest rates

Quick transfers of funds to other Airtel Payments Bank statements and bank statements

Simple bill payments for mobile recharges, utilities, and other services

Multiple layers of authentication for secure transactions

Requirements to Open a Bank Account with Airtel Payments

You need to fulfill the following requirements in order to be eligible to create an account with Airtel Payments Bank:

-

- You have to be a resident of India

You have to be at least eighteen years old

You need to have a PAN card, if applicable, and a working Aadhaar number.It is necessary for you to have an Airtel mobile number linked to your name

How to Register for an Airtel Payments Bank Account

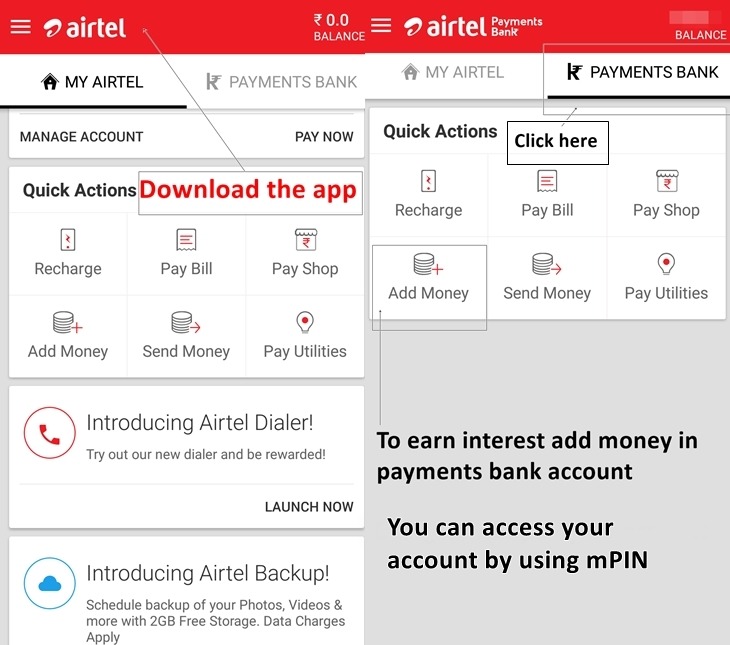

Download the Airtel Thanks App as the first step

Download the Airtel Thanks app from the App Store (iPhone users) or Google Play Store (android users) to start the account opening procedure. Make sure you have the most recent version of the app installed if you already have it installed.

Step2: Open an Airtel Payments Bank account

Select the “Payments Bank” icon after launching the Airtel Thanks app. Click “Register Now” to start the registration process if you’re a new user. Entering your Airtel mobile number and confirming it with an OTP (One-Time Password) provided to your phone will be required.

Step 3: Finish the KYC procedure

Your Airtel Payments Bank account will not be active until the Know Your Customer (KYC) process is finished. You can accomplish this by going to any Airtel Payments Bank banking location or authorized Airtel merchant. For verification, bring your PAN card (if applicable) and Aadhar card. Your biometric information will be collected by the shop to finalize the KYC procedure.

Setting Your MPIN is Step 4

You’ll be asked to create a 4-digit MPIN (Mobile PIN) for your Airtel Payments Bank account after completing the KYC procedure. You will need this MPIN in order to access your account and approve transactions.

Step 5: Open Your Bank Account for Airtel Payments

You can use your Airtel Payments Bank account to send money, pay bills, and more once it has been activated and your MPIN has been created. By using the Airtel Thanks app or by calling *400# from your registered Airtel phone number, you can access your account.

Frequently Asked Questions Concerning the Opening of a Bank Account for Airtel Payments

Do Airtel Payments Bank accounts have to have a minimum balance requirement?

No, savings accounts at Airtel Payments Bank do not need to have a minimum balance. To receive interest on your account, you might, nevertheless, have to keep a minimum amount in place.

If I don’t have an Airtel mobile number, can I still open an Airtel Payments Bank account?

No, in order to open an Airtel Payments Bank account, you need to have an Airtel mobile number registered in your name. Prior to up an account, you must obtain an Airtel number if you don’t already have one.

Is there a cost to open a bank account with Airtel Payments?

The process of creating an Airtel Payments Bank account is free of charge. However, for some services or operations, such cash withdrawals or money transfers to other banks, there can be fees.

Result

The process of opening an account with Airtel Payments Bank is quick and easy, requiring only a few simple steps to complete. You can rapidly set up your account and begin taking advantage of digital banking with Airtel Payments Bank by following the above advice and making sure you match the eligibility requirements. Whether you want to pay bills, move money, or save money, Airtel Payments Bank provides a simple and safe platform to handle your financial requirements.

Add Comment