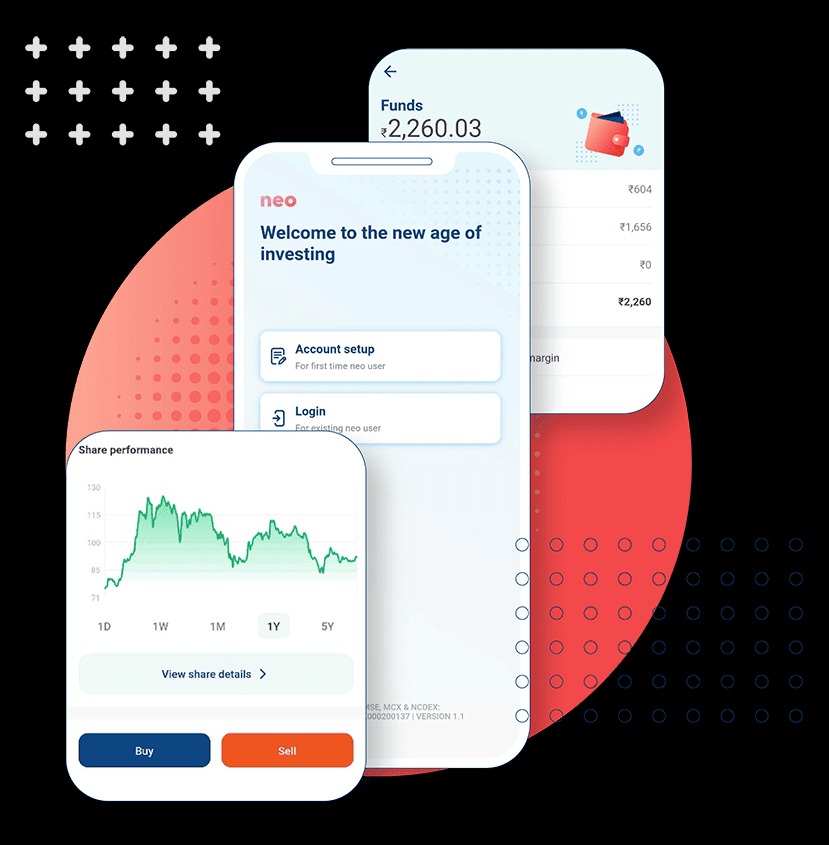

One of the top private sector banks in India offers Kotak Neo, a ground-breaking digital banking platform. Kotak Neo is designed to provide customers with a seamless, paperless, and instant account opening experience, all from the comfort of their homes. With Kotak Neo, you can enjoy a host of features and benefits, such as zero balance requirements, high interest rates, and a virtual debit card for online transactions. In this comprehensive guide, we’ll walk you through the step-by-step process of opening a Kotak Neo account, from downloading the app to completing the KYC video and activating your account.

The Kotak Neo account is an ideal choice for individuals who value convenience, flexibility, and digital-first banking solutions. By opening a Kotak Neo account, you can manage your finances, make transactions, and earn attractive interest on your savings, all through a user-friendly mobile app.

Whether you’re a tech-savvy millennial, a working professional, or someone who prefers the ease of digital banking, the Kotak Neo account is designed to cater to your needs. In the following sections, we’ll provide a detailed guide on how to open a Kotak Neo account, along with some frequently asked questions and tips to help you make the most of your account. So, let’s dive in and explore the world of Kotak Neo!

Step 1: Download the Kotak Neo Mobile App

To begin the process of opening a Kotak Neo account, you’ll need to download the Kotak Neo mobile app on your smartphone. The app is available for both Android and iOS devices.

For Android users:

- Open the Google Play Store on your Android device.

- In the search bar, type “Kotak Neo” and press enter.

- Select the official Kotak Neo app from the search results. Kotak Mahindra Bank Ltd. ought to be in charge of developing it.

- Tap on the “Install” button to download and install the app on your device.

For iOS users:

- Open the App Store on your iOS device.

- In the search bar, type “Kotak Neo” and press enter.

- Select the official Kotak Neo app from the search results. Kotak Mahindra Bank Ltd. ought to be in charge of developing it.

- Tap on the “Get” or “Install” button to download and install the app on your device.

Step 2: Register and Verify Your Mobile Number

Once the Kotak Neo app is installed on your device, open the app and tap on the “Open an Account” button. You’ll be prompted to enter your mobile number for registration and verification.

Enter your 10-digit mobile number and tap on the “Proceed” button. Kotak Neo will send an OTP (one-time password) to your registered mobile number for verification.

When you receive the OTP, enter it in the app to verify your mobile number. After successful verification, you’ll be able to proceed with the account opening process.

Step 3: Fill Out the Basic Details

After verifying your mobile number, you’ll need to fill out some basic details in the app. These details include:

- Full Name: Enter your full name as per your PAN card.

- Date of Birth: Select your date of birth from the calendar.

- Gender: Choose your gender from the options provided.

- PAN Number: Enter your 10-digit PAN number for identity verification.

- Email Address: Provide your email address for communication and account-related notifications.

Make sure to enter accurate information, as it will be used for KYC verification and account setup.

Step 4: Complete the Video KYC Process

One of the unique features of the Kotak Neo account is the video KYC process, which allows you to complete your Know Your Customer (KYC) verification instantly through a video call.

To start the video KYC process, tap on the “Start Video KYC” button in the app. You’ll be connected to a Kotak Mahindra Bank representative via a secure video call.

During the video KYC, you’ll need to:

- Show your PAN card and a valid address proof document (such as Aadhaar card, passport, or driving license) to the camera.

- Answer a few basic questions asked by the bank representative to confirm your identity and address.

- Provide your signature by holding a plain piece of paper with your signature written on it in front of the camera.

The video KYC process usually takes around 5–10 minutes to complete. Once your KYC is successfully verified, your Kotak Neo account will be opened instantly.

Step 5: Set Your Account Preferences

After your Kotak Neo account is opened, you can set your account preferences in the app. These preferences include:

- Account Nickname: Choose a nickname for your Kotak Neo account for easy identification.

- Debit Card Preferences: Select whether you want a physical debit card or a virtual debit card for your account.

- Cheque Book Request: If you require a check book for your account, you can place a request through the app.

- Nomination Details: You can nominate a person who will be entitled to receive the funds in your account in the event of your demise.

You can always modify these preferences later through the app’s settings.

Step 6: Fund Your Account and Start Using It

Congratulations! Your Kotak Neo account is now active and ready to use. To start using your account, you’ll need to fund it. You can add money to your Kotak Neo account through various methods, such as:

- UPI (Unified Payments Interface): Transfer money instantly from another bank account using UPI.

- NEFT/IMPS: Use Net Banking or visit a Kotak Mahindra Bank branch to transfer funds through NEFT or IMPS.

- Cash Deposit: Deposit cash at any Kotak Mahindra Bank branch or ATM that accepts cash deposits.

Once your account is funded, you can start using it for various transactions, such as online payments, bill payments, money transfers, and more. You can also use your virtual or physical debit card for shopping and cash withdrawals.

Frequently Asked Questions

- Is there a minimum balance requirement for the Kotak Neo account?

No, the Kotak Neo account has zero balance requirements, which means you don’t need to maintain a minimum balance in your account. - What documents are required for opening a Kotak Neo account?

You need a valid PAN card and an address proof document (such as an Aadhaar card, passport, or driving license) to open a Kotak Neo account. These documents will be verified during the video KYC process. - How long does it take to open a Kotak Neo account?

The Kotak Neo account opening process is instant. Once you complete the video KYC and your KYC is verified, your account will be opened immediately. - Is the Kotak Neo account safe and secure?

Yes, the Kotak Neo account is highly secure. Strong security measures from Kotak Mahindra Bank, such as 128-bit SSL encryption, two-factor authentication, and secure OTP verification for transactions, back it up.

Conclusion

Opening a Kotak Neo account is a quick, easy, and paperless process that can be completed entirely through the Kotak Neo mobile app. By following the step-by-step guide provided in this article, you can open your account in a matter of minutes and start enjoying the benefits of digital banking with Kotak Mahindra Bank.

The Kotak Neo account offers a range of features and benefits, such as zero balance requirements, high interest rates, virtual debit cards, and instant fund transfers, making it an attractive choice for individuals looking for a convenient and flexible banking solution.

To make the most of your Kotak Neo account, keep your account information secure, explore the various features and services offered through the app, and take advantage of the attractive interest rates to grow your savings.

If you have any questions or need assistance with your Kotak Neo account, you can reach out to Kotak Mahindra Bank’s customer support team through the app or by visiting their website. They are available to help you with any queries or issues you may have.

Embrace the future of banking with Kotak Neo and enjoy the convenience, flexibility, and security of a truly digital banking account. Open your Kotak Neo account today and take the first step towards smarter, simpler, and more rewarding banking!

Add Comment