Revolut is a digital banking platform that offers a range of financial services, including current accounts, savings, investments, and currency exchange. By opening a Revolut account, you can access a multi-currency account, make transactions in over 150 currencies, and benefit from competitive exchange rates and low fees. Revolut’s user-friendly app and innovative features make it a popular choice for people looking for a flexible and cost-effective way to manage their money.

One of the key advantages of using Revolut is its global accessibility. You can open a Revolut account from many countries around the world, and the app supports multiple languages, making it easy to manage your finances while traveling or living abroad. Additionally, Revolut offers a range of account tiers, from the free Standard account to the premium Metal account, allowing you to choose the features and benefits that best suit your needs.

In this guide, we will walk you through the process of opening a Revolut account, enabling you to start enjoying the benefits of digital banking and borderless money management.

Step 1: Download the Revolut App

Visit the App Store (for iOS devices) or Google Play Store (for Android devices) on your smartphone. Search for “Revolut” and download the official app. Once the download is complete, install the app on your device.

Step 2: Launch the Revolut App

Locate the Revolut app icon on your smartphone’s home screen or app drawer, and tap on it to launch the application.

Step 3: Start the Account Opening Process

On the Revolut welcome screen, tap on the “Get Started” or “Sign Up” button to begin the account opening process.

Step 4: Enter Your Personal Information

Provide the required personal details, such as your name, email address, mobile phone number, and residential address. You’ll also need to create a secure password for your Revolut account.

Step 5: Verify Your Identity

To comply with financial regulations and prevent fraud, Revolut requires you to verify your identity. Follow the in-app instructions to submit a valid government-issued ID, such as a passport or driver’s license, and take a selfie for facial recognition.

Step 6: Choose Your Account Plan

Select the Revolut account plan that best suits your needs. The available plans may include Standard, Premium, and Metal, each with varying features and benefits. Review the plan details and pricing before making your choice.

Step 7: Fund Your Account

To start using your Revolut account, you’ll need to add funds. You can do this by making a bank transfer from your existing bank account or by using a debit or credit card. Follow the in-app instructions to securely add funds to your Revolut account.

Step 8: Set Up Your Card

Once your account is funded, you can order a physical Revolut card for making purchases and ATM withdrawals. Choose your card design and delivery address, and your card will be shipped to you.

Step 9: Explore Revolut’s Features

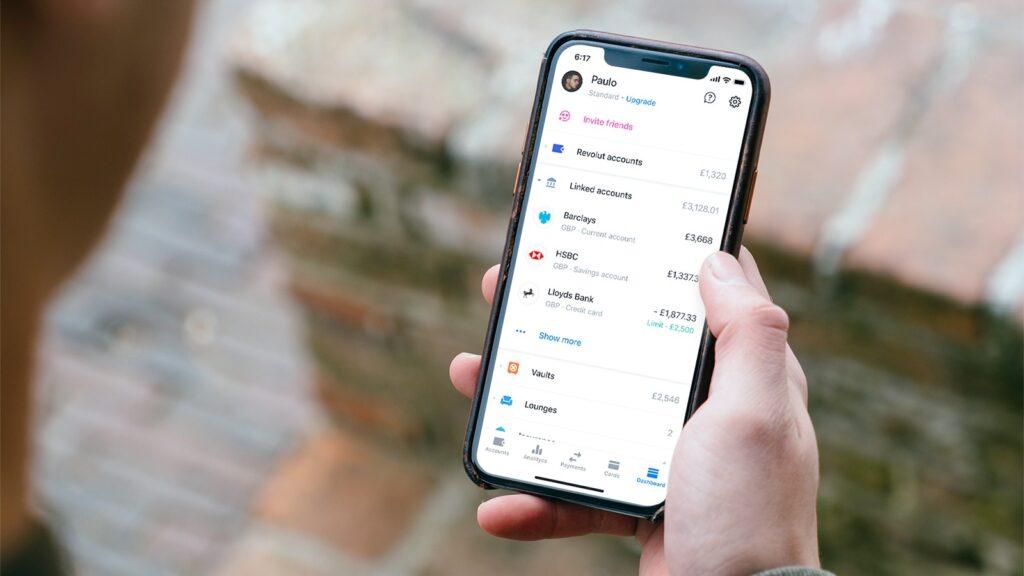

Familiarize yourself with Revolut’s various features, such as:

- Multi-currency accounts and exchange

- Budgeting and analytics tools

- Savings Vaults and Goals

- Investments and commodities

- Insurance and device protection

Start using these features to manage your money, save for your goals, and make the most of your Revolut account.

Congratulations! You have successfully opened a Revolut account and are ready to enjoy the benefits of digital banking. As you continue to use the app, you’ll discover more ways to save money, manage your finances, and take advantage of Revolut’s innovative features.

Remember to keep your account secure by using a strong password, enabling two-factor authentication, and regularly monitoring your transactions. With Revolut, you have the power to take control of your financial life and enjoy borderless money management at your fingertips.

Add Comment