Users of Paytm, a well-known digital payment network in India, can conduct transactions, settle debts, and keep money in a virtual wallet. It is possible to register a Paytm account without a bank account, even though most customers link their accounts to one. We’ll go through how to open a Paytm account without a bank account as well as the features and restrictions of this kind of account in this post.

The advantages of opening a Paytm account without first opening a bank account

You could desire to register a Paytm account without a bank account for a number of reasons.

-

- You don’t want to link your bank account to Paytm, or you don’t have one.You should keep your Paytm transactions and bank account transactions apart

You wish to utilize Paytm’s services, such bill payment and mobile recharge, without disclosing your bank information

Limitations of a Paytm Account in the Absence of a Bank Account

Although it is possible to register a Paytm account without a bank account, there are a few restrictions to take into account:

-

- You will not be able to utilize any Paytm Payments Bank services, including a debit card or savings account

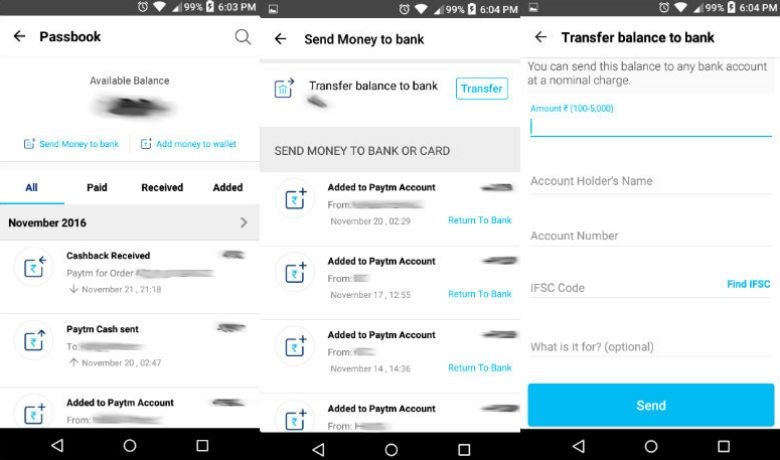

Money transfers from your Paytm wallet to a bank account are not possible

Compared to accounts connected to a bank account, you might have lower transaction limits

How to Open a Paytm Account Without a Bank Account: A Step-by-Step Guide

First, get the Paytm app.

Download the Paytm app from the App Store (for iPhone users) or Google Play Store (for Android users) to start the account opening procedure. Alternatively, you can register by going to the Paytm website.

Step 2: Enter your mobile number and click “Sign Up”

After accessing the Paytm application or website, select the “Sign Up” option. After entering your cell phone number, select “Generate OTP.” Your cellphone number will receive a one-time password (OTP) from Paytm for verification.

Step 3: Create a Password and Enter the OTP

Create a secure password for your Paytm account and enter the OTP that you received on your mobile device. Make sure your password is complex enough to need a combination of special characters, digits, and letters, and that it is hard to figure out.

Step 4: Enter Your Personal Information

Enter your name, email address, and birthdate in the personal information field. In addition, you will need to enter your address information and choose a profile image.

Step 5: Confirm Your Customer (KYC) Information

You must finish the KYC procedure in order to utilize Paytm’s services. By presenting your Aadhaar card details or another kind of official identification, you can accomplish this. Additional documents may be required by Paytm depending on the services you wish to use.

Step 6: Open Your Paytm Account and Begin Using It

You may use your Paytm account to make purchases, pay bills, and recharge your phone as soon as it’s been set up and your KYC information has been confirmed. You can use a credit card, another Paytm user’s wallet, or a Paytm partner store to add funds to your Paytm wallet.

Common Questions Concerning Paytm Account Opening Without a Bank Account

I don’t have a bank account; can I still get money in my Paytm account?

It is possible to receive money in your Paytm wallet from other users, even if there isn’t a bank account associated with it. You will not, however, be able to move this money to a bank account.

Is there a maximum amount of cash that can be kept in an unbanked Paytm wallet?

Yes, there are restrictions on how much money you may use your Paytm wallet to keep and send. Paytm sets certain limits, which can change based on your account type and KYC status. For the most recent information on transaction and storage restrictions, make sure to check with Paytm.

Is a bank account required to utilize Paytm’s Payments Bank services?

No, you must register a separate Paytm Payments Bank account and complete the required KYC procedures in order to access Paytm’s Payments Bank services, such as a debit card or savings account. To accomplish this, you must link your PAN and Aadhaar cards to your account.

Result

Without a bank account, opening a Paytm account is an easy process that only takes a few minutes to finish. Even though utilizing a Paytm account without a bank account tied to it has certain restrictions, it can still be a practical way to conduct transactions, pay bills, and save money online. You can rapidly set up your Paytm account and begin enjoying its services by following the above step-by-step procedure and supplying the required KYC details. Just be mindful of the transaction and storage limitations specific to your account type, and use strong passwords to safeguard your account.

Add Comment