Easypaisa has revolutionized mobile financial services in Pakistan’s quickly changing digital world. You may enter a world of ease, security, and financial empowerment by opening an Easypaisa account. With the help of this in-depth tutorial, you will be able to open your own Easypaisa account and start enjoying a number of advantages.

Why Create an Account with Easypaisa?

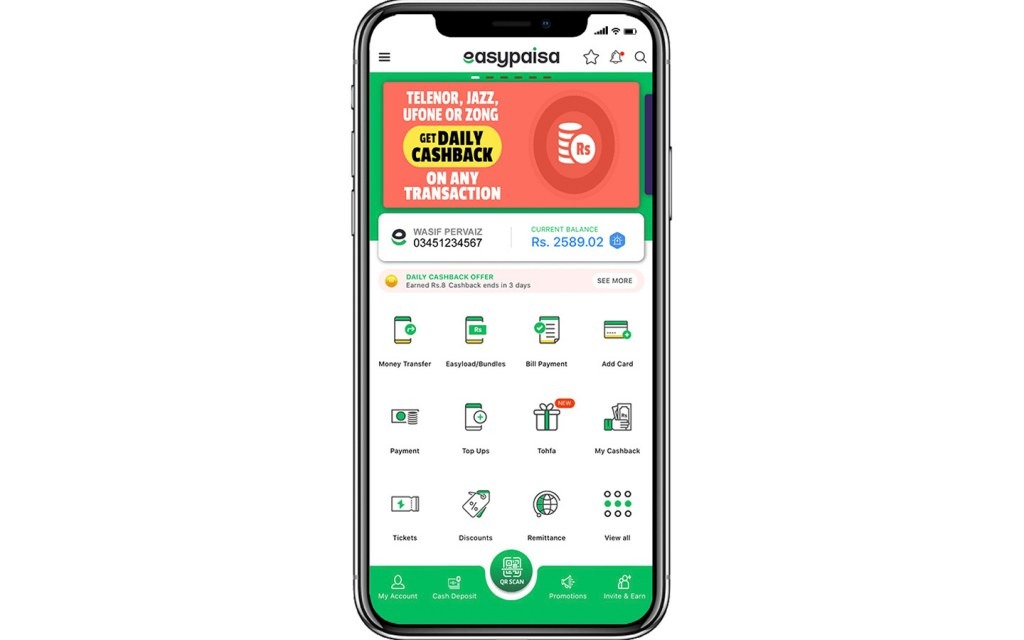

The innovative mobile banking service Easypaisa, offered by Telenor Microfinance Bank, has completely changed how people and companies handle their financial transactions. You can benefit from the ease of sending and receiving money, paying bills, buying mobile top-ups, and much more, all from your phone by opening an Easypaisa account. You can take charge of your financial life with an Easypaisa account, regardless of whether you’re a professional, student, or small business owner.

What Advantages Do Easypaisa Accounts Offer?

Creating an account on Easypaisa opens up a world of advantages aimed at streamlining your financial dealings. You may easily pay utility bills, school fees, and other costs with an Easypaisa account. You can also buy cell top-ups and bundles for yourself and other people. You can send and receive money instantaneously from anywhere in Pakistan.

– Make safe online payments while shopping.

– Transact cash with a large network of Easypaisa agents; – Have piece of mind with dependable and secure financial services

Detailed Instructions for Opening an Easypaisa Account

Starting an Easypaisa adventure is a very easy and clear process. To open your Easypaisa account and begin taking advantage of mobile financial services, follow these easy steps:

Step 1: Go to a Telenor franchise or Easypaisa agent

Find a nearby Easypaisa agent or Telenor franchise to start the opening an Easypaisa account procedure. Because of their widespread availability throughout Pakistan, these authorized stores make it easy for you to get the services you require.

Step 2 requires you to provide your personal information.

You will be required to give your personal details, such as your complete name, CNIC (Computerized National Identity Card) number, and mobile phone number, at the Easypaisa agent or Telenor franchise. Make certain that the data you offer is correct and current.

Step 3: Send in the Necessary Documents

In order to initiate the process of opening an Easypaisa account, you will be required to provide specific documentation for validation. Generally, you’ll have to supply:

A duplicate of your current CNIC

– A current passport-sized picture

– Documentation proving your address, like a utility bill or rental agreement

Setting Your MPIN is Step 4

You will be required to establish your MPIN (Mobile Personal Identification Number) when submitting your documents. Your secure password for logging into your Easypaisa account and approving transactions will be this five-digit code. Select a distinctive and memorable MPIN that is easy for you to remember but challenging for others to figure out.

Activate Your Easypaisa Account: Step Five

After completing the registration process and having your documents authenticated, the activation of your Easypaisa account will occur. Your account is now operational; you will receive a confirmation SMS on the number you registered.

Step 6: Open Your Easypaisa Account and Begin Using It

You can immediately begin taking advantage of the ease of mobile banking services once your Easypaisa account has been authorized. To access a variety of services, such as bill payments, mobile top-ups, money transfers, and more, use the Easypaisa app or USSD menu. To get the most out of this effective financial instrument, explore the features and functionalities available in your account.

Common Questions Regarding Establishing an Easypaisa Account

1. What is the minimum age to create an Easypaisa account?

Indeed, you need to have a valid CNIC and be at least 18 years old in order to open an Easypaisa account. This stipulation guarantees adherence to legal and regulatory requirements for financial services in Pakistan.

2. If I don’t have a smartphone, can I still open an Easypaisa account?

Of course! Even without a smartphone, you can still open and utilize an Easypaisa account. Easypaisa provides an intuitive USSD menu that is accessible from any entry-level mobile phone. To complete transactions and gain access to account services, just phone *786# and follow the instructions.

3. Does creating an Easypaisa account cost money?

It costs nothing to open an Easypaisa account. There aren’t any costs associated with opening or keeping an account. However, depending on Easypaisa’s fee schedule, some transactions—like money transfers or bill payments—may be subject to small fees.

Use Easypaisa to Empower Yourself Now

Creating an account on Easypaisa is your entryway to a world of empowerment and financial ease. You may quickly establish your own Easypaisa account and begin taking advantage of mobile banking services by following the instructions provided in this article. Easypaisa is your go-to partner for hassle-free, safe transactions whether you’re paying bills, sending money to loved ones, or buying online. With Easypaisa, your partner in growth, take charge of your financial situation right now.

Unlock Monetary Convenience: A Comprehensive Guide to Opening an Easypaisa Account

Easypaisa has revolutionized mobile financial services in Pakistan’s quickly changing digital world. You may enter a world of ease, security, and financial empowerment by opening an Easypaisa account. With the help of this in-depth tutorial, you will be able to open your own Easypaisa account and start enjoying a number of advantages.

Why Create an Account with Easypaisa?

The innovative mobile banking service Easypaisa, offered by Telenor Microfinance Bank, has completely changed how people and companies handle their financial transactions. You can benefit from the ease of sending and receiving money, paying bills, buying mobile top-ups, and much more, all from your phone by opening an Easypaisa account. You can take charge of your financial life with an Easypaisa account, regardless of whether you’re a professional, student, or small business owner.

What Advantages Do Easypaisa Accounts Offer?

Creating an account on Easypaisa opens up a world of advantages aimed at streamlining your financial dealings. You may easily pay utility bills, school fees, and other costs with an Easypaisa account. You can also buy cell top-ups and bundles for yourself and other people. You can send and receive money instantaneously from anywhere in Pakistan.

– Make safe online payments while shopping.

– Transact cash with a large network of Easypaisa agents; – Have piece of mind with dependable and secure financial services

Detailed Instructions for Opening an Easypaisa Account

Starting an Easypaisa adventure is a very easy and clear process. To open your Easypaisa account and begin taking advantage of mobile financial services, follow these easy steps:

Step 1: Go to a Telenor franchise or Easypaisa agent

Find a nearby Easypaisa agent or Telenor franchise to start the opening an Easypaisa account procedure. Because of their widespread availability throughout Pakistan, these authorized stores make it easy for you to get the services you require.

Step 2 requires you to provide your personal information.

You will be required to give your personal details, such as your complete name, CNIC (Computerized National Identity Card) number, and mobile phone number, at the Easypaisa agent or Telenor franchise. Make certain that the data you offer is correct and current.

Step 3: Send in the Necessary Documents

In order to initiate the process of opening an Easypaisa account, you will be required to provide specific documentation for validation. Generally, you’ll have to supply:

A duplicate of your current CNIC

– A current passport-sized picture

– Documentation proving your address, like a utility bill or rental agreement

Setting Your MPIN is Step 4

You will be required to establish your MPIN (Mobile Personal Identification Number) when submitting your documents. Your secure password for logging into your Easypaisa account and approving transactions will be this five-digit code. Select a distinctive and memorable MPIN that is easy for you to remember but challenging for others to figure out.

Activate Your Easypaisa Account: Step Five

After completing the registration process and having your documents authenticated, the activation of your Easypaisa account will occur. Your account is now operational; you will receive a confirmation SMS on the number you registered.

Step 6: Open Your Easypaisa Account and Begin Using It

You can immediately begin taking advantage of the ease of mobile banking services once your Easypaisa account has been authorized. To access a variety of services, such as bill payments, mobile top-ups, money transfers, and more, use the Easypaisa app or USSD menu. To get the most out of this effective financial instrument, explore the features and functionalities available in your account.

Common Questions Regarding Establishing an Easypaisa Account

1. What is the minimum age to create an Easypaisa account?

Indeed, you need to have a valid CNIC and be at least 18 years old in order to open an Easypaisa account. This stipulation guarantees adherence to legal and regulatory requirements for financial services in Pakistan.

2. If I don’t have a smartphone, can I still open an Easypaisa account?

Of course! Even without a smartphone, you can still open and utilize an Easypaisa account. Easypaisa provides an intuitive USSD menu that is accessible from any entry-level mobile phone. To complete transactions and gain access to account services, just phone *786# and follow the instructions.

3. Does creating an Easypaisa account cost money?

It costs nothing to open an Easypaisa account. There aren’t any costs associated with opening or keeping an account. However, depending on Easypaisa’s fee schedule, some transactions—like money transfers or bill payments—may be subject to small fees.

Use Easypaisa to Empower Yourself Now

Creating an Easypaisa account is your first step toward a world of empowerment and ease with money. You may quickly establish your own Easypaisa account and begin taking advantage of mobile banking services by following the instructions provided in this article. Easypaisa is your go-to partner for hassle-free, safe transactions whether you’re paying bills, sending money to loved ones, or buying online. With Easypaisa, your partner in growth, take charge of your financial situation right now.

Add Comment