To begin investing in the stock market, follow these steps to open a Demat account with Zerodha. Leading Indian online stockbroker Zerodha is renowned for its solid technology, affordable prices, and easy-to-use interface. We’ll walk you through the process of opening a Demat account with Zerodha in this in-depth guide, enabling you to get started investing with confidence.

Why Open a Demat Account with Zerodha?

Investors can benefit from Zerodha in a number of ways, including:

-

- Minimal brokerage fees and upfront costs

Friendly smartphone app and online trading platform (Kite)

Detailed tutorials and educational materials for novices

Quick account opening and dependable client service

a large selection of financial goods, such as derivatives, mutual funds, and stocks

A Step-by-Step Guide on Opening a Demat Account at Zerodha

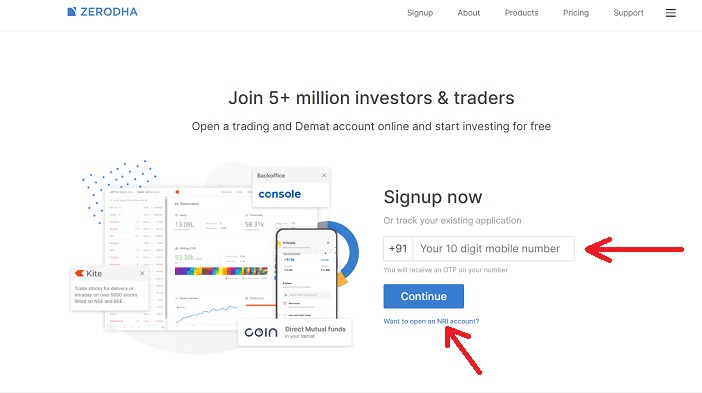

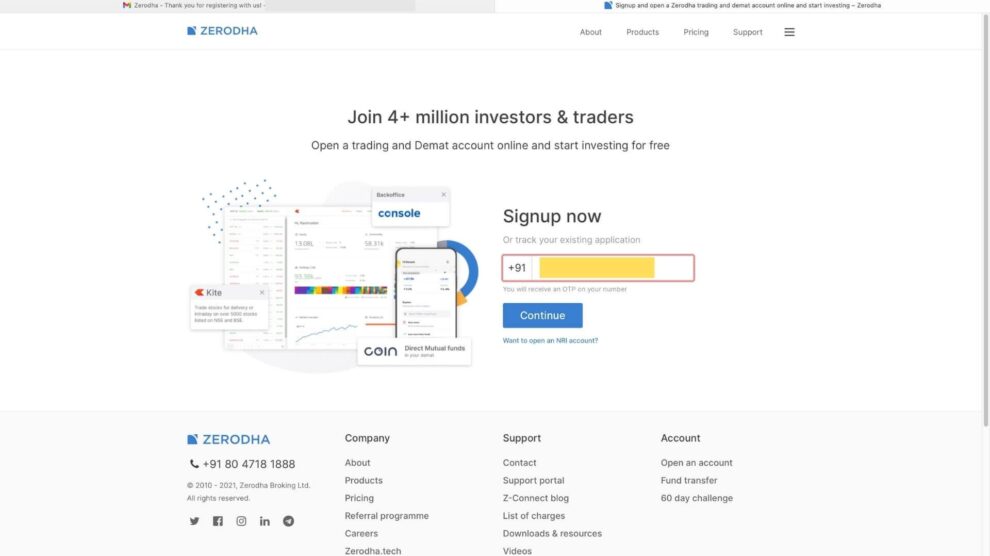

Step 1 is to visit the Zerodha website.

Visit https://zerodha.com/ to access the official Zerodha website. Select the “Sign up” or “Open an account” button, which is often found in the upper-right corner of the homepage.

Step 2 involves completing the online account opening form.

An online form to open an account will be sent to you. Give correct personal and financial details, such as your name, birthdate, address, phone number, email address, and PAN (Permanent Account Number). Make sure the information corresponds with your official records.

Step 3: Confirm Your Email Address and Cell Phone Number

For verification, Zerodha will send an OTP (One-Time Password) to the email address and registered mobile number you provided. To continue with the account opening process, enter the OTP in the appropriate boxes.

Step 4: Finish the Know Your Customer (KYC) Procedure

You must finish the KYC procedure in order to abide by regulatory obligations. Upload copies of the following documents that are readable and clear:

-

- PAN card

- Aadhaar card or passport (for evidence of address)

- Cancelled check or bank statement (for verification of bank account)

Photo the size of a passport

A digital signature or scanned copy of a signature specimen

With Zerodha’s eKYC process, you can use your Aadhaar card and OTP-based authentication to finish the KYC verification online.

In-person verification, or IPV (Step 5)

A valid IPV is required in order to open a Demat account, as per SEBI requirements. With Zerodha’s user-friendly video IPV process, you can finish the verification by having a video conversation with a Zerodha representative. Choose a time that works well for the video IPV, and make sure your internet connection is steady.

Step 6: Electronically Sign the Agreement

You will receive an email with a link to electronically sign the account opening agreement after completing the IPV and KYC procedures. Carefully read the agreement, then sign it digitally by uploading a scanned copy of your wet signature or using Aadhaar-based eSign.

Activation of Account: Step 7

Your trading and Demat accounts will be enabled as soon as Zerodha has processed your application and verified your documentation. An email confirmation including your account information, such as your Client ID and Demat account number, will be sent to you.

Initiate Trading and Fund Your Account in Step 8

You must fund your Zerodha trading account before you can begin trading. Proceed to the “Funds” area of your Zerodha Kite account after logging in. Use NEFT, RTGS, or IMPS to transfer money from your registered bank account. As soon as the money is credited, you can begin making stock market investments.

Frequently Asked Questions regarding Zerodha Demat Account Opening

How much does it cost to start a Zerodha Demat account?

For Demat and trading accounts, Zerodha does not impose any account opening fees. Nonetheless, there are reasonable fees for transaction processing and account upkeep, which are competitive within the sector. For a thorough cost schedule, visit Zerodha’s website.

How long does it take to register for a Zerodha Demat account?

With Zerodha, creating an account is a quick and easy process. After completing the IPV, KYC, and online application forms, your account can be authorized in one to two working days. The verification process and the thoroughness of your application, however, may affect the actual duration.

If I’m a non-resident Indian (NRI), may I open a Demat account with Zerodha?

NRIs are able to open trading and demat accounts on Zerodha, yes. For NRIs, the account opening procedure and necessary paperwork can be different, though. Additional documentation will be required from you, including an NRI status verification, proof of a foreign address, and a PIS (Portfolio Investment Scheme) letter from your bank. It is advised to get in touch with Zerodha’s customer service if you need particular advice on opening an NRI account.

Is opening a Demat account contingent upon having a trading account with Zerodha?

A Demat account, trading account, and bank account are all included in the 3-in-1 package that Zerodha offers. A trading account is immediately opened with Zerodha when you open a Demat account. This enables you to invest and trade in the stock market on a single platform with ease.

Result

A quick and easy approach to begin investing in the stock market is to open a Demat account with Zerodha. You can open an account with confidence if you follow this step-by-step guide on how to open a Demat account in Zerodha. To start trading, don’t forget to fill out the KYC and IPV forms completely, fund your account, and supply correct information. Zerodha is a great option for both novice and seasoned investors due to its user-friendly platform, affordable fees, and instructional resources. To optimize your possible returns when you start your investing adventure, always make well-informed decisions, diversify your portfolio, and never stop learning.

Add Comment