Mobile payment apps like PhonePe have completely changed how we transact and handle our funds in today’s fast-paced digital world. It only takes a few minutes to create an account with PhonePe, which opens up a world of advantages and convenience. We’ll lead you through the process of opening a PhonePe account in this detailed guide, giving you the ability to take charge of your digital transactions.

Why Opt for PhonePe?

Let us examine the reasons for millions of users choosing PhonePe as their preferred option before delving into the intricacies of how to register an account in PhonePe:

- Seamless UPI Transactions: Sending and receiving money straight from your bank account is made simple with PhonePe’s ability to provide quick, safe, and secure money transfers over the Unified Payments Interface (UPI).

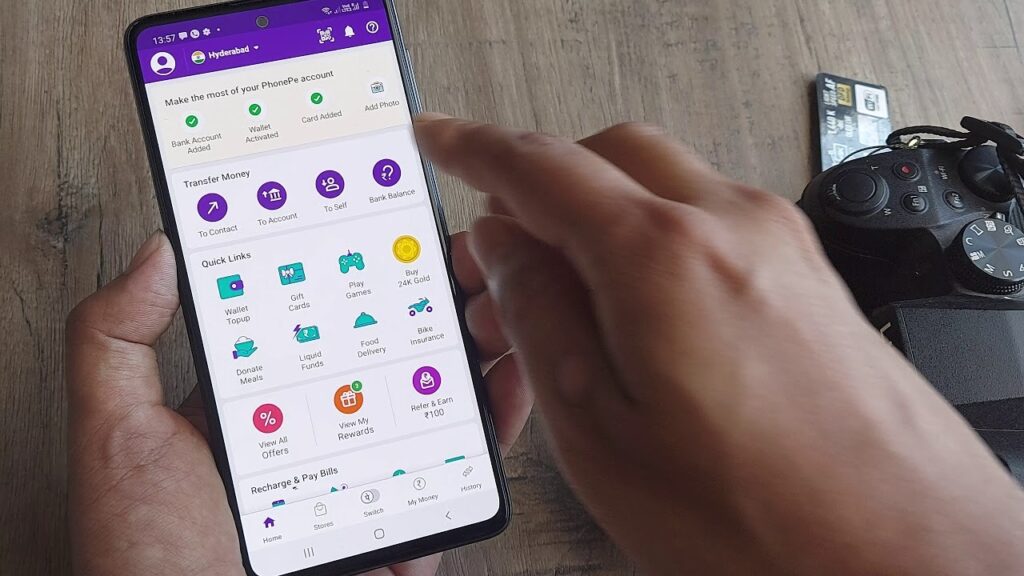

- Broad Range of Services: PhonePe provides a multitude of services, all within a single app, in addition to money transactions. These services include mobile recharges, bill payments, investments, insurance, and more.

- User-Friendly Interface: PhonePe’s user interface is simple to use and straightforward, making it suitable for users of all tech skill levels and ages.

- Strong Security Measures: PhonePe places a high premium on your financial security and uses cutting-edge encryption and security procedures to protect your private data and transactions.

- enticing Offers and prizes: PhonePe often gives users who use its services cashback, discounts, and other enticing prizes, which helps you save money while taking advantage of a flawless digital experience.

A Comprehensive Guide: How to Register for a PhonePe Account

Having grasped the advantages of utilizing PhonePe, let’s proceed to the process of opening an account in PhonePe:

First, get the PhonePe app.

Download the PhonePe app from the Apple App Store (for iOS devices) or Google Play Store (for Android devices) to start your PhonePe adventure. Make sure the app was created by PhonePe Private Limited and look for the official PhonePe app, which has a purple logo.

Step 2: Set Up and Open the Application

To install the app on your device after it has downloaded, tap the PhonePe icon. Launch the app after installation to start the account setup procedure.

Enter your mobile number in step three

In the allocated space on the welcome screen of the PhonePe app, input your cell number. It is important that you input the number linked to your active SIM card, since PhonePe will use this number to verify your identity by sending an OTP (one-time password).

Step 4: Confirm Your Cell Phone Number

Once your cellphone number has been entered, press the “Verify” button. An OTP will be sent to the registered cellphone number by PhonePe. To validate your phone number and continue setting up your account, enter the OTP in the app.

Create a UPI PIN in Step 5

PhonePe asks you to generate a UPI PIN in order to protect your transactions and guarantee the security of your account. You will need this 4-digit PIN to authorize all of your app-based transactions. Select a PIN that will be simple for you to remember but challenging for others to figure out.

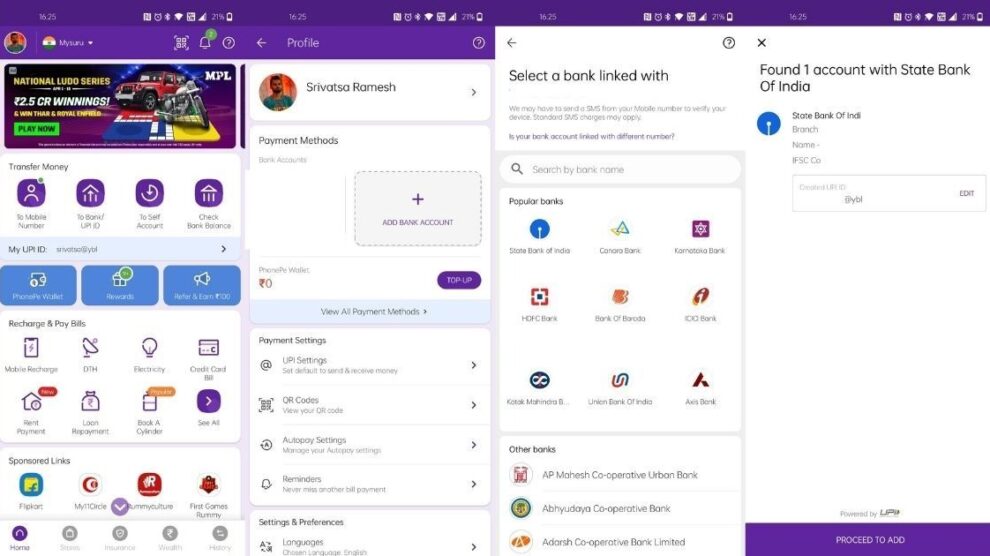

Link Your Bank Account in Step Six

Connecting your bank account to your PhonePe account is necessary in order to take full advantage of all of its features and facilitate easy transactions. Take these easy actions:

- In the app, tap the “Profile” section and choose “Bank Accounts.”

- Click “Link Bank Account” and choose your bank from the list of participating financial institutions.

- Enter the necessary information, including your account number and IFSC code, after selecting the bank account you want to link.

- Your bank account will be connected to your PhonePe account once PhonePe has successfully verified the data of your account.

Step 7: Finish the KYC (Know Your Customer) process

You need to finish your KYC process on PhonePe in order to unlock higher transaction limits and comply with regulatory standards. How to do it is as follows:

- In the app, tap the “Profile” section and choose “KYC.”

- Enter the necessary information together with your Permanent Account Number (PAN).

- For verification, upload a clean picture of your PAN card along with a selfie.

- PhonePe will check your KYC information, and if it’s authorized, you’ll get access to more features and higher transaction limits.

Best wishes! Now That You’ve Used PhonePe

Now that your PhonePe account is created and operational, you can start utilizing the app’s numerous functions. To help you get going, consider these few pointers:

- Send Money: Send money to any UPI ID or your contacts instantaneously by using the “Send Money” option.

- Recharge & Pay Bills: Use the PhonePe app to immediately pay your utility bills, recharge your cell phone, or connect to DTH service.

- Explore Services: By tapping on the “Services” part of the app, you may learn about a variety of services, such as investing, insurance, and more.

- Check Rewards: To be informed about the most recent deals, cashback, and discounts offered on PhonePe, keep a watch on the “Rewards” area.

Safeguarding Your PhonePe Credentials

Even though PhonePe uses strong security measures to safeguard your account and transactions, you should still adhere to recommended guidelines to secure your finances:

- Never divulge your OTP, UPI PIN, or any other private information to anyone, not even PhonePe staff members.

- For further security, enable facial recognition or fingerprint authentication.

- Update your PhonePe app frequently to guarantee you have access to the most recent features and security patches.

- Keep an eye on your transaction history and notify PhonePe’s customer service right away if you see any unusual activity.

Result

Creating a PhonePe account is an easy and rewarding process that gives you the ability to manage your online purchases. This comprehensive guide will walk you through the process of opening an account in PhonePe, so you can start using the app’s features and services right away and link your bank.

When you start using PhonePe, don’t forget to put account security first and take use of all the features available to streamline your financial life. You can have the ease, quickness, and dependability of digital transactions at your fingertips when PhonePe is on your side.

What are you waiting for then? To experience the digital payment of the future, download the PhonePe app now!

Add Comment