The cryptocurrency markets are witnessing a sharp downturn, fueled by widespread panic surrounding Google’s groundbreaking quantum chip, Willow. As the details of Willow’s capabilities become clearer, concerns have emerged about its potential to disrupt the foundational principles of blockchain technology. You find yourself in the middle of a pivotal moment for digital assets, where the integration of quantum computing and blockchain is no longer a speculative debate but a pressing reality.

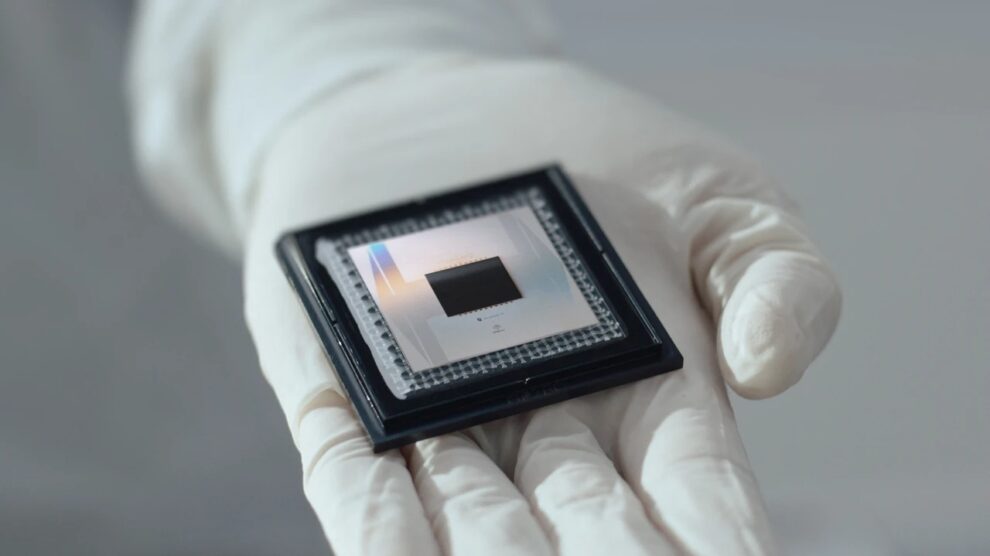

The crux of the issue lies in the unparalleled processing power of Willow, a quantum chip designed to solve computations at speeds far beyond those of traditional supercomputers. This technological leap has raised fears that it could break the cryptographic safeguards underpinning cryptocurrencies like Bitcoin and Ethereum. With market sentiment already shaky, the introduction of this quantum development has added fuel to the fire, resulting in plummeting asset prices and intensified speculation about the future of blockchain security.

To understand the current market volatility, you must first delve into the intricate interplay between quantum computing and blockchain encryption. Bitcoin and most other cryptocurrencies rely on cryptographic algorithms, such as SHA-256 and elliptic curve cryptography, to secure transactions and maintain ledger integrity. These algorithms are robust against classical computing attacks, but the advent of quantum processors like Willow poses a different challenge. Quantum computers use principles of superposition and entanglement to process information at unprecedented scales, potentially enabling them to decrypt encrypted data in a fraction of the time required by even the most powerful classical computers.

A Historic Sell-Off and Market Responses

As news of Willow’s potential capabilities spread, cryptocurrency prices tumbled, with Bitcoin shedding nearly 15% of its value in just 48 hours and Ethereum following suit with a 10% decline. Other altcoins, particularly those with smaller market caps, have fared even worse, experiencing losses of up to 25%. This mass sell-off reflects not only investor fear but also a broader uncertainty about whether current cryptographic protocols can withstand the pressures of quantum decryption.

Despite the steep declines, market analysts suggest this reaction may be rooted more in speculation than immediate risk. Quantum computing, while advancing rapidly, is still in its infancy. For now, the ability to exploit blockchain vulnerabilities remains theoretical rather than practical. Yet, the psychological impact of this revelation has created a sense of urgency among stakeholders, from developers to regulators, to address the looming challenges posed by quantum breakthroughs.

To better grasp the potential impact of Willow, it’s essential to evaluate the vulnerabilities in current cryptographic systems. Cryptocurrencies rely on public and private key pairs to secure transactions. These keys are generated through algorithms that are practically unbreakable by classical computers, as they would require computational resources far exceeding those available today.

Quantum computers, however, introduce algorithms like Shor’s algorithm, which can theoretically factorize large numbers exponentially faster than classical methods. This capability could render many encryption methods obsolete, exposing private keys and allowing unauthorized access to cryptocurrency wallets. While quantum-resistant cryptographic techniques are under development, they are not yet widely implemented, leaving a significant portion of the blockchain ecosystem potentially vulnerable.

A Table of Market Declines

| Cryptocurrency | 24-Hour Loss (%) | 7-Day Loss (%) | Market Capitalization (in Billion USD) |

|---|---|---|---|

| Bitcoin | 15% | 18% | 600 |

| Ethereum | 10% | 12% | 250 |

| Cardano | 22% | 30% | 20 |

| Solana | 25% | 35% | 15 |

This table illustrates the extent of the sell-off, highlighting the cascading impact of quantum computing fears across the cryptocurrency market.

The announcement of Willow has drawn mixed reactions from industry leaders and governments alike. On one hand, blockchain developers and cryptographers are accelerating efforts to implement quantum-resistant algorithms, often referred to as post-quantum cryptography. These algorithms are designed to withstand both classical and quantum attacks, offering a potential safeguard against future vulnerabilities.

On the other hand, some governments see Willow as an opportunity rather than a threat. Centralized financial systems, which have long been critical of decentralized cryptocurrencies, may view quantum computing as a means to regulate or even dismantle blockchain-based systems. This dual perspective underscores the complexity of navigating this technological intersection, where innovation and security must coexist.

Future Prospects and the Road Ahead

As you navigate the uncertain waters of cryptocurrency investments, it’s crucial to recognize the adaptive nature of blockchain technology. While the threat of quantum computing is real, the blockchain community has historically demonstrated resilience and innovation in addressing challenges. From the advent of decentralized finance to the proliferation of layer-2 scaling solutions, the industry has consistently evolved to meet emerging demands.

The rise of Willow serves as a wake-up call, pushing the blockchain ecosystem to prioritize security enhancements and prepare for a quantum future. Projects like Ethereum 2.0, which focus on scalability and sustainability, may also integrate quantum-resistant features as part of their long-term development strategies. Similarly, Bitcoin’s development community is likely to explore updates to its protocol to ensure its continued robustness against quantum threats.

The cryptocurrency markets’ reaction to Google’s quantum chip Willow reflects both the promise and peril of technological advancement. While the immediate risks to blockchain security may be overstated, the long-term implications are undeniable. You are witnessing a pivotal moment, where the integration of quantum computing forces a reevaluation of foundational technologies that have defined the digital era.

As the industry grapples with these challenges, collaboration among developers, regulators, and academics will be essential in ensuring the integrity and resilience of blockchain systems. For now, the market may remain volatile, but the lessons learned during this period of uncertainty will shape the future of cryptocurrencies and their role in a quantum-powered world.

Add Comment