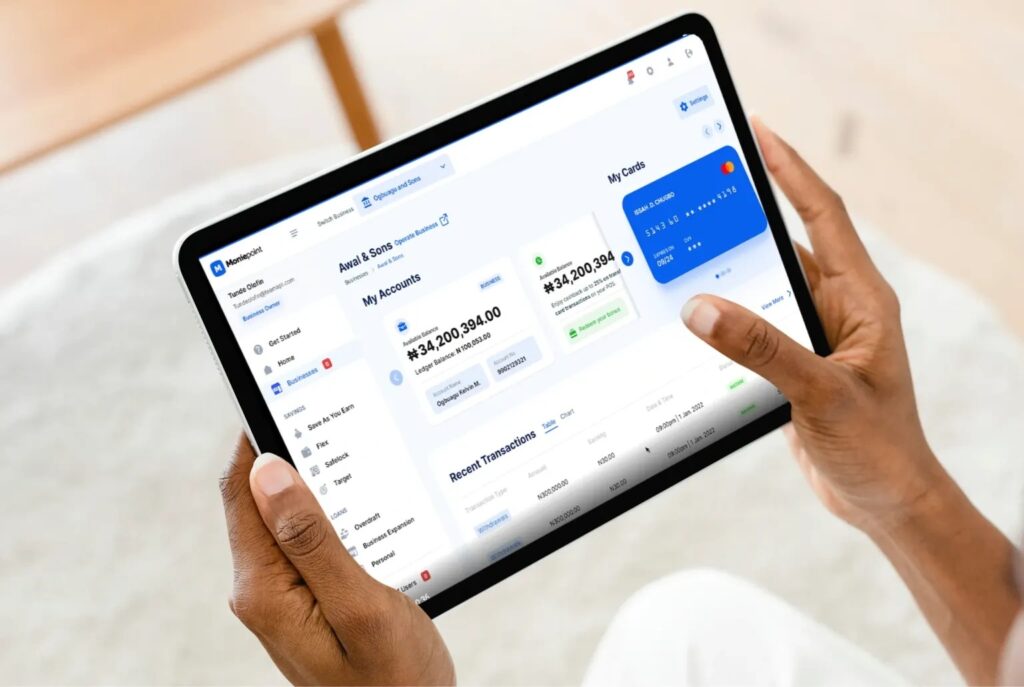

Moniepoint is a digital banking platform that offers a range of financial services to individuals and businesses in Nigeria. With a Moniepoint account, you can easily send and receive money, pay bills, and manage your finances from your mobile device. In this guide, we’ll walk you through the process of opening a Moniepoint account.

Step 1: Download the Moniepoint App

To get started, download the Moniepoint app from the Google Play Store (for Android devices) or the App Store (for iOS devices). Look for the app with the Moniepoint logo and ensure it is published by “TeamApt Limited”.

Once the app is installed on your device, open it and tap on the “Sign Up” button on the welcome screen.

Step 2: Provide Your Personal Information

On the registration screen, you’ll need to provide the following personal information:

- First Name and Last Name

- Email Address

- Phone Number

- Date of Birth

- Gender

Make sure to provide accurate and up-to-date information, as Moniepoint will use this to verify your identity and set up your account.

Step 3: Create a Secure Password

Next, create a strong and unique password for your Moniepoint account. Your password should be at least 8 characters long and include a mix of uppercase and lowercase letters, numbers, and special characters.

Confirm your password by entering it again in the designated field.

Step 4: Accept the Terms and Conditions

Before proceeding, read through Moniepoint’s Terms and Conditions and Privacy Policy. These documents outline your rights and responsibilities as a Moniepoint user, as well as how your personal information will be collected, used, and protected.

If you agree to the terms, tap on the checkbox to accept them.

Step 5: Verify Your Phone Number

To ensure the security of your account, Moniepoint will send a verification code to the phone number you provided during registration. Enter the code in the app when prompted to verify your phone number.

If you don’t receive the code within a few minutes, tap on the “Resend Code” button to request a new one.

Step 6: Set Up Your Transaction PIN

Once your phone number is verified, you’ll be asked to set up a 4-digit Transaction PIN. This PIN will be required to authorize transactions and access certain features within the app.

Choose a PIN that is easy for you to remember but difficult for others to guess. Avoid using obvious combinations like “1234” or your birthdate.

Step 7: Provide Additional KYC Information

To comply with Nigerian banking regulations and anti-money laundering laws, Moniepoint may require you to provide additional Know Your Customer (KYC) information, such as:

- A valid government-issued ID (e.g., National ID card, Passport, Voter’s card)

- Your Bank Verification Number (BVN)

- Proof of address (e.g., utility bill, tenancy agreement)

You can provide this information within the app by taking clear photos of the required documents and uploading them when prompted.

Step 8: Wait for Account Approval

After submitting your KYC information, Moniepoint will review your application and verify your identity. This process usually takes a few minutes to a few hours, depending on the completeness and accuracy of your information.

If your application is approved, you’ll receive a confirmation message within the app and via email. If there are any issues with your application, Moniepoint will contact you for clarification or additional information.

Step 9: Fund Your Account

Once your Moniepoint account is approved and activated, you can fund it using various methods, such as:

- Bank Transfer: Transfer funds from your existing bank account to your Moniepoint account using the unique account number provided in the app.

- Card Funding: Link your debit card to your Moniepoint account and top up your balance instantly.

- Agent Deposit: Visit a Moniepoint agent near you and deposit cash into your account.

Choose the funding method that is most convenient for you and follow the instructions in the app to add money to your account.

Step 10: Start Using Your Moniepoint Account

With your Moniepoint account funded, you can start using it for various financial transactions, such as:

- Sending money to other Moniepoint users or bank accounts

- Paying bills (e.g., electricity, cable TV, internet)

- Buying airtime and data

- Generating payment links to receive money from others

- Withdrawing cash from Moniepoint agents or ATMs

Explore the different features and services available in the Moniepoint app and start managing your money with ease and convenience.

Conclusion

Opening a Moniepoint account is a quick and easy process that can be completed entirely from your mobile device. By following the steps outlined in this guide and providing the necessary information and documents, you can start enjoying the benefits of digital banking with Moniepoint.

As you use your Moniepoint account, remember to keep your login credentials and transaction PIN secure, and monitor your account activity regularly for any suspicious transactions. If you have any questions or issues, don’t hesitate to contact Moniepoint’s customer support team for assistance.

With Moniepoint, you have access to a wide range of financial services that can help you manage your money more efficiently and achieve your financial goals. Start exploring the app today and take control of your finances!

Add Comment